Box Processing

Building a payment processing center for challenger banks

Box Processing

Building a payment processing center for challenger banks

Design and Development of the payment processing center for neobanks and fintechs

Location

Location

United Kingdom

Industry

Industry

Fintech

Cooperation model

Cooperation model

Dedicated Development Team

Partnership period

Partnership period

June 2019- present

Team size

Team size

4

Technologies

-

JavaLanguages

-

MySQLDatabases

-

DockerPlatforms

-

JavaScriptLanguages

-

AWSPlatforms

-

JavaScriptLanguages

-

AWSPlatforms

-

ReactLibraries

-

ReactLibraries

-

KubernetesFrameworks

-

KubernetesFrameworks

Improvements Plan

Discovery phase/ Requirements and Estimation Analysis/ Prototyping and Designing/ MVP release/ and the second project phase development

About the product

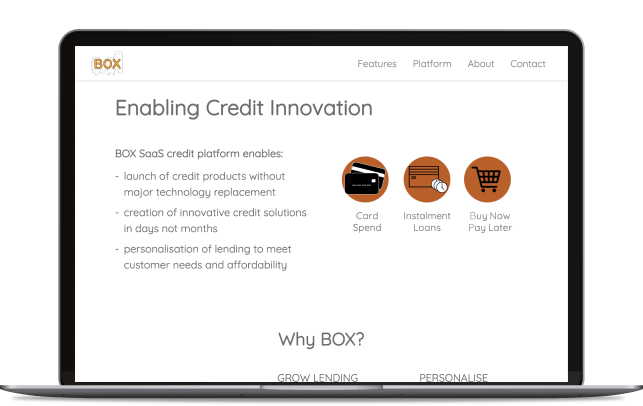

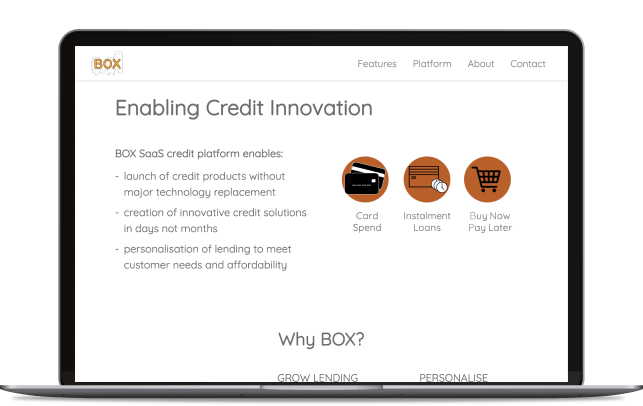

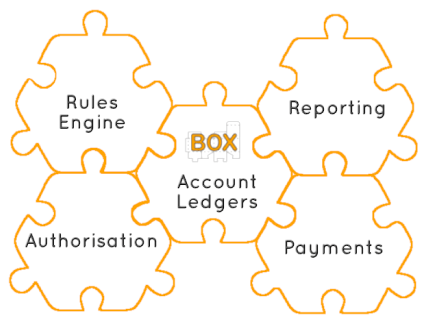

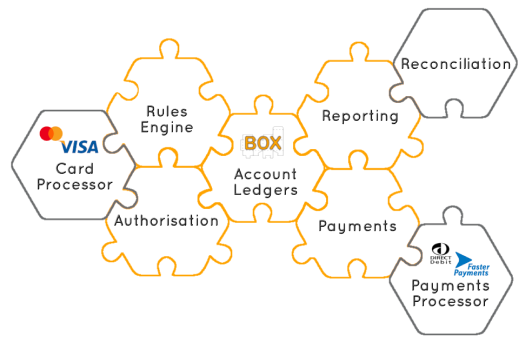

Box credit and online payments processor provides a ‘plug-in’ credit ledger for the fintech ecosystem. Through API integration with Box, neobanks and other fintechs can quickly integrate with small amounts of money and create innovative credit solutions to meet consumer and SME needs.

About the client

Box processing integrations

How we did it

The customer requested to develop a flexible SaaS lending platform from scratch. The NerdySoft task was to create a solution with personalisation of lending to meet customer needs that will make payments more affordable.

-

Develop test documentation considering all possible inputs and outputs and dependent system behavior

-

Implementation of revolving credit and instalment loans, plus support for Buy Now Pay Later

-

RESTful APIs for simple integration and flexibility to support future features

-

Development of Rules Engine for linking account behaviour to events, transactions, limits, etc.

-

Implementation of modular system to 'plug in' to existing system and third partner service providers

-

Cloud deployment for rapid set up, scalability, performance and resilience with AWS, but banks can deploy to their own cloud provider

-

Product designer feature implementation for full control of features; multiple APR rates, fees, rewards, billing cycles, repayment plans, payment methods, etc.

-

Developer sandbox to fast track integration and test products before launch

-

Develop test documentation considering all possible inputs and outputs and dependent system behavior

-

Implementation of revolving credit and instalment loans, plus support for Buy Now Pay Later

-

RESTful APIs for simple integration and flexibility to support future features

-

Development of Rules Engine for linking account behaviour to events, transactions, limits, etc.

-

Implementation of modular system to 'plug in' to existing system and third partner service providers

-

Cloud deployment for rapid set up, scalability, performance and resilience with AWS, but banks can deploy to their own cloud provider

-

Product designer feature implementation for full control of features; multiple APR rates, fees, rewards, billing cycles, repayment plans, payment methods, etc.

-

Developer sandbox to fast track integration and test products before launch

Main Features

Box platform allows to launch of credit products without major technology replacement

Box provides real-time authorisation for financial transactions based on account balance and rules. Third party card processors provide the connection to Visa and Mastercard and manage the card lifecycle

It helps neobanks to reduce costs by using SaaS platform to ‘plug in’ or replace legacy systems

It allows challenger banks to grow lending revenue by launching new and innovative credit products quicker than traditional processors

You can personalize your lending to suit customer needs including flexible loans based on ability to repay

Result

Box is an innovative and flexible SaaS lending platform that manages credit limits and bank account balance, authorises credit card payments in real time, disburses loans and collects savings, calculates accrued interest and fees, provides statement data, triggers repayments & updates funds received, reports and updates general ledgers.

NerdySoft team is always supporting innovative approaches in the fintech industry. Box is an example of cutting edge technology with a specific architecture, created in order to simplify and speed up the process of launching credit products for challenger banks.

Result

Box is an innovative and flexible SaaS lending platform that manages credit limits and bank account balance, authorises credit card payments in real time, disburses loans and collects savings, calculates accrued interest and fees, provides statement data, triggers repayments & updates funds received, reports and updates general ledgers.

NerdySoft team is always supporting innovative approaches in the fintech industry. Box is an example of cutting edge technology with a specific architecture, created in order to simplify and speed up the process of launching credit products for challenger banks.

NerdySoft has been a great partner for BOX, helping us build our credit platform and get it to market faster than any other route available. The developers have become part of our team and we’ve had great support from the NerdySoft managers and technical leads.

Rob Macmillan

BOX Processing CEO

NerdySoft has been a great partner for BOX, helping us build our credit platform and get it to market faster than any other route available. The developers have become part of our team and we’ve had great support from the NerdySoft managers and technical leads.

Rob Macmillan

BOX Processing CEO

Error: Contact form not found.