Virtual Banking software

Virtual Banking software

Building a new digital banking platform for UK’s Fastest Growing Credit Card Issuer

Location

Location

United Kingdom

Industry

Industry

Banking Software

Cooperation model

Cooperation model

Dedicated engineering team

Partnership period

Partnership period

Long-term partner for over 4 years

Team size

Team size

13

Frontend

-

React.jsLibraries

-

JavaScriptLanguages

-

React NativeLibraries

-

ReduxLibraries

Backend

-

AWSPlatforms

-

SQL (Aurora)Databases

-

SonarPlatforms

-

Spring stackFrameworks

-

CassandraDatabases

-

JUnitTesting Frameworks

-

HibernateTools

-

KafkaFrameworks

-

Java 8Languages

-

HibernateTools

-

Java 8Languages

-

KafkaLanguages

Web

-

Angular 4Frameworks

Android app

-

KotlinLanguages

iOS app

-

SwiftLanguages

About the client

The UK-based Fintech company was founded in 2015 to shake up the British credit card market. It is a mobile-first business that provides digital and physical credit cards and other financing services.

The company operates a simple-to-use app and online platform offering digitally-led products with a focus on simplicity, functionality, service, and security.

The UK’s Fintech states that its mission is to redefine and simplify the credit card experience, giving people more time to do the things they love. The company’s focus is on industry-leading technologies, advantages, and innovation that push the boundaries of the current global Fintech market.

About the product

The digital-first banking system is created to simplify how people manage their money and has over 500K of active customers for now.

The platform consists of a complex of iOS and Android mobile applications, WEB version, and CRM system with chatbots and voice bots used for user support and quality account management.

The product works on multiple platforms and allows creating credit institutions based on the white-labeling approach. It includes a digital wallet and its accompanying card, foreign currency exchange services, as well as near-instant credit decisions leveraging AI.

From Idea to Cutting-edge Product

Back in Q1 2017, the UK’s Fintech startup came to Nerdysoft with the idea to set up an Android and iOS mobile app with a monolith backend.

NerdySoft set up cost-effective agile development teams to develop cross-functional app backends for a mobile bank, build MVP, pivot and accelerate the product’s time-to-market.

-

Our development team has created a custom CRM to help our client make its own brand launch to pioneers.

-

Operating client presentation layers built through React Native Mobile App & Web Self Service Portals utilizing ReactJS

-

Microservices architecture was built on the Spring Framework using REST API and Kafka as their communication layers

The main goal was to have small and frequent releases and invest in automation and infrastructure for continuous releases.

1st Official Launch of White Label Product

Back in 2018 in cooperation with Nerdysoft, our client launched its first product on the British market.

Our team was responsible for the architecture, design, and development of a point of sale payment solution for one of the largest fashion retailers in Britain (an Amazon-type everything store).

The product provides an ongoing credit account to use exclusively on the retailer’s website. You can use your Flexible Payments account to spread the cost of your purchases.

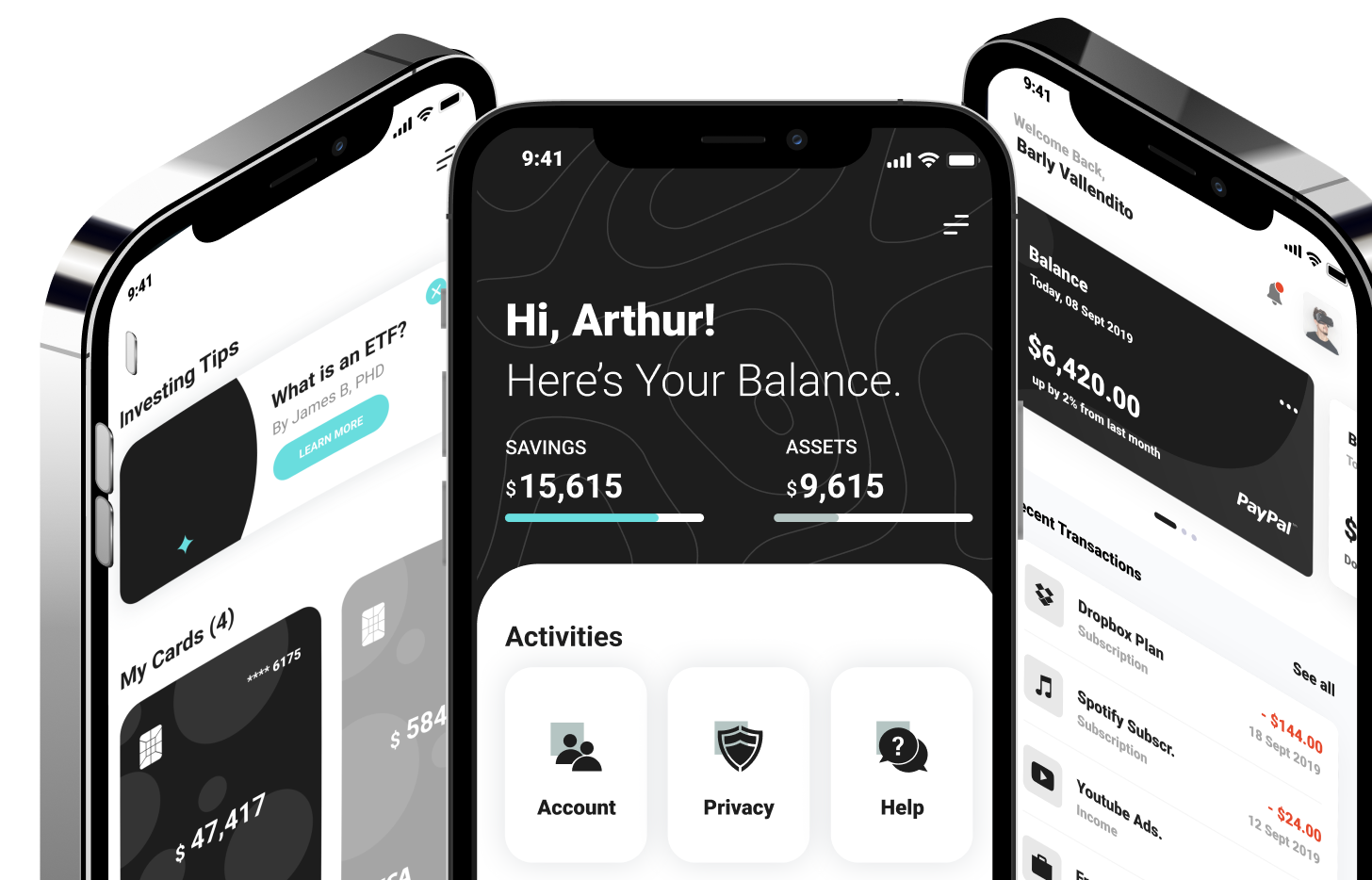

iOS and Android Application for digital-first banking solution

Next year, in 2019, together with a client we managed to launch customer-centric iOS and Android apps for a mobile-first credit card.

The product was designed to change the consumer experience with the banking industry as we know it, making credit cards simpler and easier to manage.

The first clients of the product got a comprehensive list of capabilities both in iOS.

No more complicated forms

Intuitive chat-based interface helps to set up an account in minutes. You simply scan your driving license or passport and the app will do all the scoring checks simultaneously

Real-time control of your funds

You can manage your finances in real-time, do card replacements in seconds, transfer funds between your cards, and even share your credit limit with friends or family

After designing and implementing various components of V1, our team ensured that applications were secure enough and provided support for the V1 version after launch.

In cooperation with technology experts from the client’s team, we proved the viability of the microservices approach and devitalized the initial architecture of V2 to make its implementation ready.

From Startup to Enterprise

2019 was a year of changes for our client. After a successful launch of a mobile banking application, our client – UK Fintech Startup pays $671 in cash to acquire one of the biggest UK credit card businesses.

This was a turning point in the company’s evolution. The direction was taken to scale up the company’s position in the Fintech market.

The client decides to develop a scalable, low-cost platform that will include 3 digital banking products with a unique combination of features.

After a long discussion, the NerdySoft team proposed to a client to create 4 focused end-to-end SAFe teams with common quarter objectives instead of a single SCRUM team. This was a challenging solution which in result, turned out to be a success.

Platform

- Focused on enablers and NFRs

- Mostly Back-end and infrastructure scope

- Typically ahead of other teams

iOS and Android Mobile Apps

- End-to-end mobile team consisting of BE, mobile devs and QAs

Web

- End-to-end web team consisting of BE, web devs and QAs

Other

- On-demand extendable team, e.g. support, Web #

1st Official Launch of White Label Product

Back in 2018 in cooperation with NerdySoft, our client launched its first product on the British market.

Our team was responsible for the architecture, design, and development of a point of sale payment solution for one of the largest fashion retailers in Britain (an Amazon-type everything store).

The product provides an ongoing credit account to use exclusively on the retailer’s website. You can use your Flexible Payments account to spread the cost of your purchases.

iOS and Android Application for digital-first banking solution

Next year, in 2019, together with a client we managed to launch customer-centric iOS and Android apps for a mobile-first credit card.

The product was designed to change the consumer experience with the banking industry as we know it, making credit cards simpler and easier to manage.

The first clients of the product got a comprehensive list of capabilities both in iOS and Android applications.

No more complicated forms

Intuitive chat-based interface helps to set up an account in minutes. You simply scan your driving license or passport and the app will do all the scoring checks simultaneously

Real-time control of your funds

You can manage your finances in real-time, do card replacements in seconds, transfer funds between your cards, and even share your credit limit with friends or family

After designing and implementing various components of V1, our team ensured that applications were secure enough and provided support for the V1 version after launch.

In cooperation with technology experts from the client’s team, we proved the viability of the microservices approach and devitalized the initial architecture of V2 to make its implementation ready.

From Startup to Enterprise

2019 was a year of changes for our client. After a successful launch of a mobile banking application, our client – UK Fintech Startup pays $671 in cash to acquire one of the biggest UK credit card businesses.

This was a turning point in the company’s evolution. The direction was taken to scale up the company’s position in the Fintech market.

The client decides to develop a scalable, low-cost platform that will include 3 digital banking products with a unique combination of features.

After a long discussion, the NerdySoft team proposed to a client to create 4 focused end-to-end SAFe teams with common quarter objectives instead of a single SCRUM team. This was a challenging solution which in result, turned out to be a success.

Platform

- Focused on enablers and NFRs

- Mostly Back-end and infrastructure scope

- Typically ahead of other teams

iOS and Android Mobile Apps

- End-to-end mobile team consisting of BE, mobile devs and QAs

Web

- End-to-end web team consisting of BE, web devs and QAs

Other

- On-demand extendable team, e.g. support, Web #

Building a Platform that will Change the Face of Credit cards... forever!

2020 was a difficult year for the whole world, but we managed to launch a scalable, low-cost card platform.

This technology platform allows our client, a UK Fintech company, to bring life not only to their own financial products but from a range of partner businesses.

As for now, the platform includes 3 different digital banking solutions with a unique combination of features.

Key Features of Digital-first platform

Creating an account is seconds

Simply scan your driving license or passport and get approved in seconds: 30 seconds to get a decision, 120 seconds to issuance.

Instant card issue

Your card will be issued instantly into the app so you can begin using it straight away.

Real-time control

Stay in control with transactions and intelligent notifications, detect fraud and block your card anytime from the app.

Credit sharing

Share your credit limit with your friends or family whenever you need it.

Liquidity buffer

Let the app automatically top up your minimum credit card balance to your current account to avoid any charges.

ReFlex

Repayment flexibility to convert your credit card balance into an installment loan when you need it.

In-app security & fraud prevention

Freeze or unfreeze your card, report it is stolen or lost in the app or online servicing account.

Flexible payments

Take control of your account and manage it online in the app.

Easy management

Categorize your transactions and make them easier to manage and track your spendings.

- Creating an account is seconds

- Instant card issue

- Real-time control

- Credit sharing

- Liquidity buffer

- ReFlex

- In-app security & fraud prevention

- Flexible payments

- Easy management

Simply scan your driving license or passport and get approved in seconds: 30 seconds to get a decision, 120 seconds to issuance.

Your card will be issued instantly into the app so you can begin using it straight away

Stay in control with transactions and intelligent notifications, detect fraud and block your card anytime from the banking app.

Share your credit limit with your friends or family whenever you need it.

Let the app automatically top up your minimum credit card balance to your current account to avoid any charges.

Repayment flexibility to convert your credit card balance into an installment loan when you need it.

Stay in control with transactions and intelligent notifications, detect fraud and block your card anytime from the banking app.

Take control of your account and manage it online in the app.

Categorize your transactions and make them easier to manage and track your spendings.

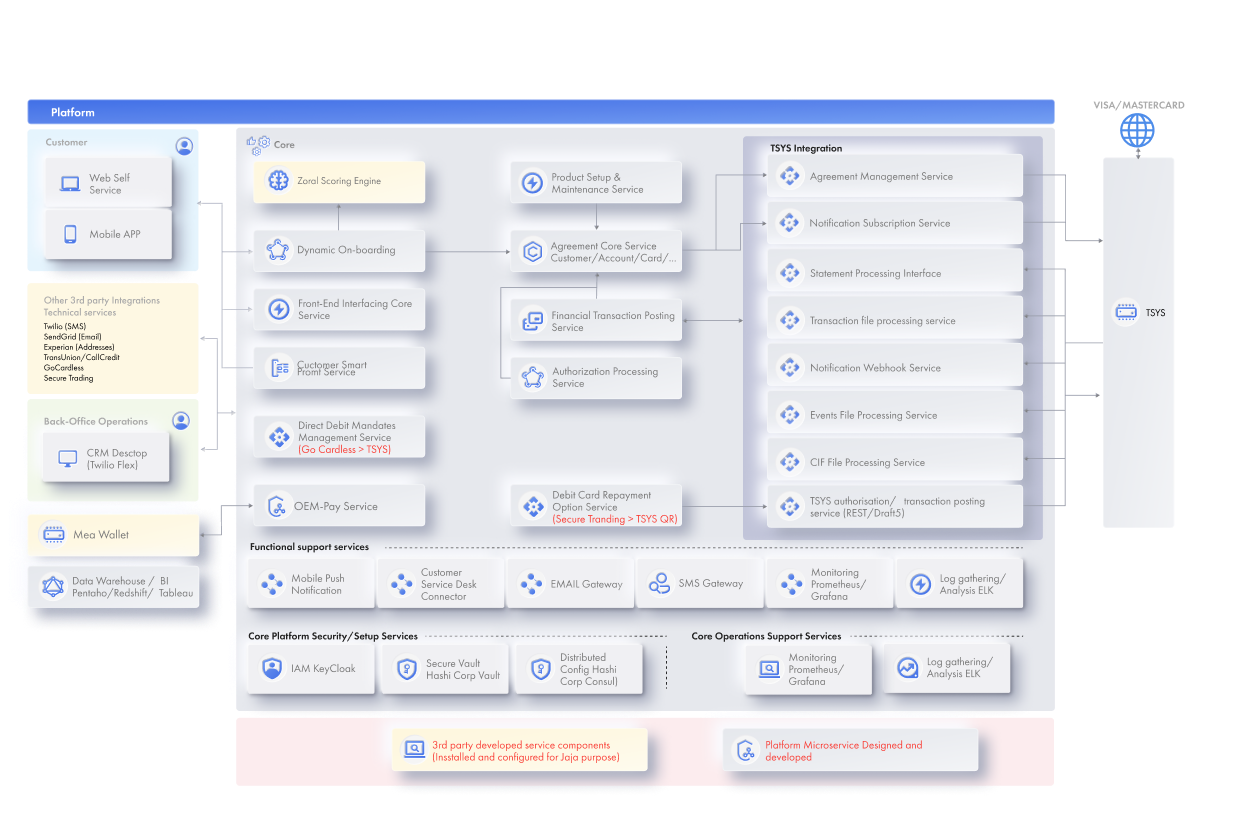

Core of Digital-first platform

Core of digital-first banking platform

Result

Simplicity is core. The client’s mission has been to bring a more modern approach to the world of credit and credit cards.

For years the UK card market is dominated by big banks who have had little interest or incentive to innovate in cards, the 0% Balance Transfers have been the only area of competition or development and we succeeded.

Our client is an innovative company that shares a commitment to delivering outstanding customer service. Together with UK fintech, we’ve created a platform that will change the face of credit cards forever! It’s fast, easy to use, intelligent, and packed full of amazing features.

Result

Simplicity is core. The client’s mission has been to bring a more modern approach to the world of credit and credit cards.

For years the UK card market is dominated by big banks who have had little interest or incentive to innovate in cards, the 0% Balance Transfers have been the only area of competition or development and we succeeded.

Our client is an innovative company that shares a commitment to delivering outstanding customer service. Together with UK fintech, we’ve created a platform that will change the face of credit cards forever! It’s fast, easy to use, intelligent, and packed full of amazing features.

Error: Contact form not found.