Cashix

Design & Development of instant loan app: a complex fintech mobile app for instant credits

Design and Development of mobile application for instant credits

Location

Location

Switzerland

Industry

Industry

Fintech

Cooperation model

Cooperation model

Time & Material

Partnership period

Partnership period

Sept. 2019 - Oct. 2020

Team size

Team size

4

CG24 Web

-

ReactLibraries

-

JestTesting framework

-

ReduxLibraries

Cashix Mobile App

-

TypescriptLanguages

-

React NativeLanguages

-

FirebasePlatforms

Cashix Web Admin

-

JestTesting framework

-

TypescriptLanguages

-

ReactLibraries

Backend

-

JavaLanguages

-

KubernetesFrameworks

-

MailjetPlatforms

-

SpringFrameworks

-

DockerPlatforms

-

PostgreSQLDatabases

-

HibernateFrameworks

-

TwilioPlatfroms

-

HibernateFrameworks

-

TwilioPlatforms

About the instant loan

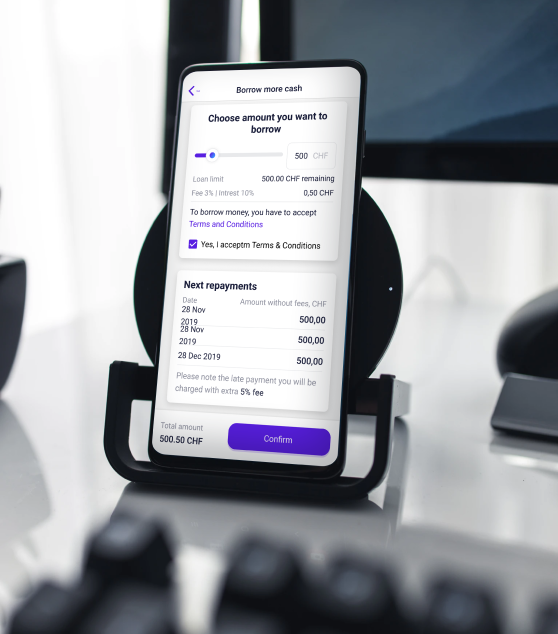

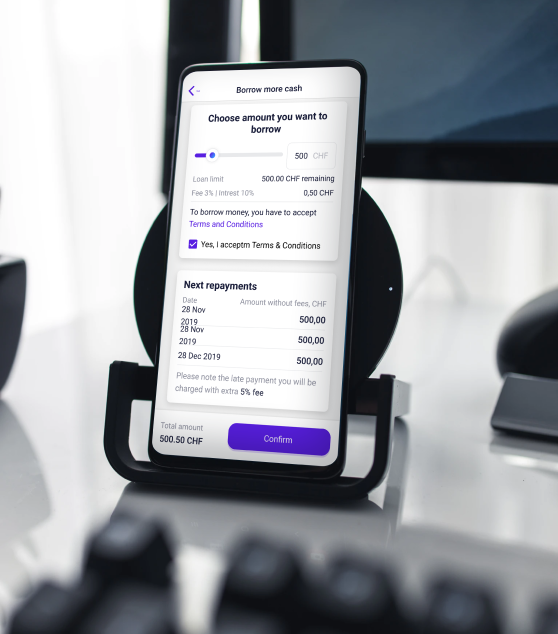

Cashix is an instant loan app: a complex fintech mobile application covering a full cycle of instant microcredits for loan amounts up to 2K Euros for individuals.

The main goal of the project was to create a service where you can instantly get a short-term loan via communication with chatbot and without filling out millions of forms and standing in queues of financial instances.

After downloading the application for iOS or Android, the user goes through a quick onboarding and validation process by third parties legal instances and in a few seconds after, can use the microcredit.

About the client

CreditGate24 is a Swiss online platform for the financing of private and business loans. The company decided to create a revolutionary product for the Swiss banking system, where instead of a bank, the instant loans are financed by private and institutional investors.

The platform was launched in March 2015 and is aimed at making the credit process more efficient, faster and comfortable to a client.

Сhallenges overview

The customer requested to create a mobile app for instant credits to individuals from scratch. An instant loan mobile application is just a tool on a way to reach a large-scale goal – change the traditional way people get microcredits in Switzerland and simplify the process to a few steps.

During the project, NerdySoft developers had to address the following challenges:

-

Initial plan was to use the existing backend for a new application. NerdySoft company suggested to develop separate backend for Cashix application and connect it with CG24 platform into a single ecosystem

-

KYC flow implementation via 4 simple steps using PlxVision tool

-

Provide fast and secure digital user verification in real time using Machine Learning and Machine Vision

-

Intelligent identity verification in real time & secure customer onboarding

-

Initial plan was to use the existing backend for a new application. NerdySoft company suggested to develop separate backend for Cashix application and connect it with CG24 platform into a single ecosystem

-

KYC flow implementation via 4 simple steps using PlxVision tool

-

Provide fast and secure digital user verification in real time using Machine Learning and Machine Vision

-

Intelligent identity verification in real time & secure customer onboarding

Solution

NerdySoft team has come to Berlin to meet a client, and after a long workshop we decided to create a unique platform that can be connected to any bank card to help users get microcredit anywhere and anytime.

The NerdySoft team was involved in the development of Cashix instant loan mobile application from scratch and suggested the following:

Easy verification via third-party instances

Develop documentation considering all possible inputs and outputs

KYC flow implementation using Machine Learning

Modern and responsive UI

Develop Cashix mobile application for iOS and Android

Credit check: User credit score check implementation during verification process

Development of user-friendly chatbot mechanism for customer support and onboarding

Credit check: User credit score check implementation during verification process

KYC flow implementation using Machine Learning

Development of user-friendly chatbot mechanism for customer support and onboarding

Develop documentation considering all possible inputs and outputs

Easy verification via third-party instances

Develop Cashix mobile application for iOS and Android

Modern and responsive UI

Result

NerdySoft helped CG24 to build a credit card with a unique combination of features that will change the industry of instant loans in Switzerland forever.

Our team has built the platform with an algorithm system, which automatically makes decisions relying on data we gather through integration with 3-rd parties. You don’t need to fill out numerous forms or stand in queues to get a personal loan in Switzerland anymore.

Soon, we are planning to launch more exciting and revolutionary features for Cashix, so stay tuned.

Result

NerdySoft helped CG24 to build a credit card with a unique combination of features that will change the industry of instant loans in Switzerland forever.

Our team has built the platform with an algorithm system which automatically makes decisions relying on data we gather through integration with 3-rd parties. You don’t need to fill out numerous forms or stand in queues to get a personal loan in Switzerland anymore.

Soon, we are planning to launch more exciting and revolutionary features for Cashix, so stay tuned.

CG24 Group had a great experience with NerdySoft in initiating the development of fully fledged microlending app. From the start the team from NerdySoft focused on the essential components of the project. The team managed the whole project highly professionally and competently from project management, over UX and UI Design and Frontend/Backend development. To top it off the excellent quality of work, they were also friendly and very pleasant to work with. We are happy to recommend NerdySoft without reservations.

Patrick Winterhoff

Chief of Staff and Projects at CG24 Group

CG24 Group had a great experience with NerdySoft in initiating the development of fully fledged microlending app. From the start the team from NerdySoft focused on the essential components of the project. The team managed the whole project highly professionally and competently from project management, over UX and UI Design and Front-/ Backend development. To top it off the excellent quality of work, they were also friendly and very pleasant to work with. We are happy to recommend NerdySoft without reservations.

Patrick Winterhoff

Chief of Staff and Projects at CG24 Group

Latest Insights

Stay informed on the latest updates and trends to follow in financial services, digital transformation and software development from NerdySoft