2022 Neobanks in the US: Knowing & Facing the Challenges

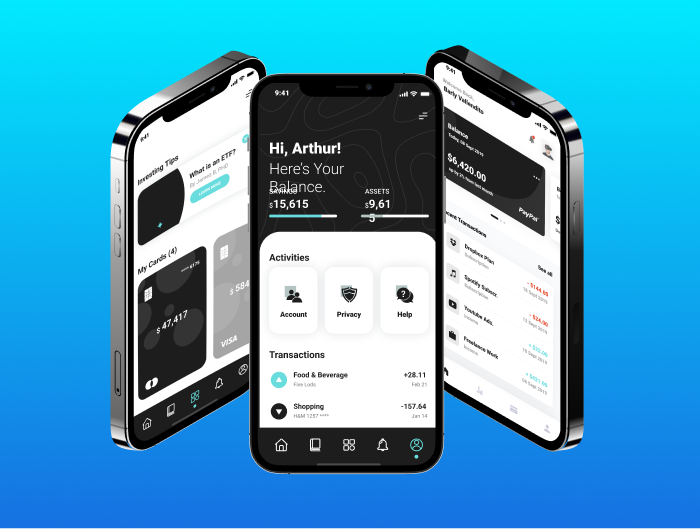

In 2022, the financial services niche is no longer available to a limited chosen few. The entry threshold has significantly lowered within the last couple of years, and if you think of starting a neobank, it’s high time to start developing your banking app. NerdySoft can be the partner of choice to help you build your innovative neobank.

Content Outline:

Neobanks in the US

Neobanks are fintech digital-only banks that are a growing challenge to traditional banks.

Understanding neobanks

A digital-only bank is a bank that has no brick-and-mortar presence with no branches. Neobank customers access their accounts and services from a computer or smartphone from anywhere in the world. Neobanks typically offer their customers higher interest rates and lower fees. For many customers, using chatbots and support systems to ask for any time anywhere assistance is a price they gladly pay to get better application services at a lower cost.

Market share and size

Typical neobanking startup and advantages they offer

Online only registration

Account setup with a traditional bank is a lengthy face-to-face-only event where you carry copies of a wide variety of documents and statements materials with you. Imagine that your target market is dentists. Suppose you focused on starting in a specific US state. In that case, you could interface with the state dental association and corporate registry to confirm that the provided driver’s license belongs to the person linked to the PCorp registered with the dentist. There are numerous ways to simplify the validation process to make opening an account faster and simpler for different types of customers.

Service integration

Now that they have an account with you, how can your neobank make things simpler for your customers? If your customers are self-employed freelancers working with a smaller pool of repeating clients, how could you make their financial management world easier? Including customer setup and activity management in your service can add significant value. Recording service activities for an existing customer, generating invoices at the appropriate milestones, presenting the invoices, and receiving payments from your platform streamlines customers’ operations. Saving time and adding value for the entrepreneur will lead to customer satisfaction and positive referrals.

Improved financial health and performance

How can you target under-serviced portions of the consumer banking market? Would those who don’t understand banking, personal finance, and financial services benefit from a platform that allows them to improve their credit rating, decrease their financing costs, consolidate loans, and better manage their budgets? Combining self-service research and education can improve your customers’ financial health while letting you cross-sell your products. Understanding your customers and targeting their needs provides self-service education materials and creates a win-win for both parties.

Integration

Your loan software cannot be an island. It needs to interact with other organizations and service providers. Start the design process by answering the following questions:

- Should you capture information from major credit bureaus?

- Should you accept payments from a variety of service providers?

- Should you integrate customer relationship management (CRM) platforms to manage marketing client campaigns?

- Should you integrate with your accounting systems?

- Should you integrate with collection and credit organizations if you need to proceed to a collections process?

2. Lack of Expertise

- Should you capture information from major credit bureaus?

- Should you accept payments from a variety of service providers?

- Should you integrate customer relationship management (CRM) platforms to manage marketing client campaigns?

- Should you integrate with your accounting systems?

- Should you integrate with collection and credit organizations if you need to proceed to a collections process?

3. Higher Prices

There is no reason to dwell too much on this one, as this is a complete hoax. There is actually no explanation to how this superstition emerged on the surface, while facts remain facts. The average hourly rate per one developer in the United States is $150; in Europe, it amounts to €150. Meanwhile, if we’re talking about Asia, Africa, and Eastern Europe (where many countries are still not part of the European Union), the damage will be approximately $75. It seems like the difference is even more than tangible, given that the quality of services might be even better.

4. Irresponsible Vendors

When you’ll hear about irresponsible vendors from outside Europe, may you ask yourself a question of how territorial affiliation can be the cause of irresponsibility? While you’re in the IT business, it is quite probable that logical reasoning is one of your core virtues. There are both responsible and irresponsible vendors within Europe and outside its boundaries. Hence, when it comes to choosing a software outsourcing company, think of their tech expertise, portfolio, and clients reviews, as this is where the grain of truth lies.

Comparison of Neobanks and Traditional Banks

From a customer’s point of view, there are many pros and cons of neobanks vs. traditional banks.

Pros

Neobanks

From a customer’s point of view, there are many pros and cons of neobanks vs. traditional banks.

- Convenience Any time anywhere, access to those services can be a huge deal to some customers. The ability to interact with client representatives after hours is another value add.

- Low rates Passing on your lower online-only bank operating costs means that lower fees, lower interest rates charged, and higher interest rates paid are good ways to improve customers’ financial position.

- Additional digital tools Another way to improve customers’ financial situation is to provide online learning tools and materials to help them manage their finances better.

- Green Paperless processes are more efficient for your customer and help them feel better about their contribution to greener business practices.

- New services Continually adding new services for your customers demonstrates your understanding of their needs and provides ongoing value for them.

Traditional banks

- Wide range of services

In addition to bank accounts, traditional banks offer a wide range of services, including loans, investments, and insurance.

- Personal service

Going into a bank and dealing face-to-face with a real person is very important to some people. - Trusted brand

Deposit insurance is crucial to the peace of mind of many customers, and they will not bank with non-insured institutions.

Deposit insurance

For risk-averse people, dealing with a trusted brand can be a showstopper when they pick their bank.

Cons

Neobanks

- Possible instability

The newness of neobanks is an area of concern for some risk-averse people.

Limited services

Not having a one-stop shop for banking services will be a problem for some customers.

- No face-to-face service

For some customers, eliminating face-to-face interactions from the banking experience is not a preferred choice.

- Deposit insurance uncertainty

The idea of losing deposits from the failure of a non-insured neobank is a deal-breaker for most people.

Traditional banks

- High customer service and facility costs

Once they understand there are alternatives, customers are no longer willing to pay the fees needed to cover the high costs of providing in-person services at high-cost locations.

- Slow to change processes and services

For most traditional banks, many processes and services are set in stone and are very slow to change. For some customers, this makes the banks look rigid and uncaring.

- Mandatory face-to-face services

Not everybody has the flexibility to get to their bank branch during operating hours.

Challenges Neobanks Face

If you build it, will the users come? Many consumers have become accustomed to getting little to no interest payments for their traditional banks’ chequing and savings accounts. Will people switch if you can build a low-cost fintech startup neobank that offers higher interest rates for savings accounts?

Integration

Setting up and operating a neobank presents challenges.

Regulatory

To run a neobank, you need an appropriate license in each of your operating jurisdictions. When starting up a neobank, you need to decide what range of services you want to provide and the path you want to get to those services. Do you want to start small and grow or start with a big bang? You can start with a financial institution license and increase your service base from there. If you operate outside of the United States, you may be able to start with a virtual banking license. You can get straight to getting your banking license. If that is too big of a reach, you could affiliate with an existing licensed bank or become a subsidiary to one.

Deposit insurance is essential to some clients. The Federal Deposit Insurance Corporation (FDIC) provides deposit insurance in the US. You can start without deposit insurance and work around client risk aversion. Other options are indirectly FDIC insured through affiliation with an insured bank or directly insured by becoming a subsidiary of an insured bank.

Tech challenges neobanks face

Deposit insurance is essential to some clients. The Federal Deposit Insurance Corporation (FDIC) provides deposit insurance in the US. You can start without deposit insurance and work around client risk aversion. Other options are indirectly FDIC insured through affiliation with an insured bank or directly insured by becoming a subsidiary of an insured bank.

Features neobanks must have

To provide the convenience your customers expect, you need to deliver a multi-platform experience with a web browser and smartphone access to similar capabilities. You also need to provide multi-channel customer service where your customers can use chat, email, and phone services to get assistance. Furthermore, you need a reliable and responsive platform that gives 24*7 access to your services and service representatives. That platform needs to be readily scalable to ensure that it is affordable initially and can expand as you grow your customer and services bases.

Security & related fintech compliances

When you establish your initial service offers and expand them over time, you must meet regulatory and industry compliance relevant to your services. Processing credit card transactions in the US involves compliance with PCI standards. You will need help determining what you need to comply with and how to establish that compliance.

Time to market constraints

Once you have established your target market and services and set up your regulatory compliance requirements (operational and technical), you want to come to market with your first services in months and not years. How do you set appropriate strategies for your hardware, software and build your services in that timeframe?

- Do you provide your hardware or use cloud-based servers?

- Do you build from scratch or use existing frameworks or platforms as a start point?

- What is your minimum viable product?

- What methodologies and tools are best suited to your evolutionary growth?

Competition from Big Tech Alternatives

When you are planning your neo banking startup, you need to assess your competitors. In addition to traditional banks and existing neobanking service providers, you need to consider Big Tech alternatives, too. Google, Apple, and Android have also entered the neobanking marketplace. How do you decide if they should be your competitors or your partner? What strategies are effective for making that decision?

Starting a Neobank

There are a variety of paths to take to start up a neobank. A key to the success of neobanks is careful targeting of select markets/segments with well-researched and planned service offers. Ease of use and powerful functionality leads to customer satisfaction and the expansion of your client base.

Do you know what sector you want to focus on? Is it a consumer segment, small/medium business (SMB) segment, or a self-employed/professional service group? Do you know what the primary pain points for your target clients are? And what can you do about it?

Now that you have a vision of your customer base and the services they need, how are you going to set up your neobank? How are you going to raise capital?

Affiliation options

There are many advantages to being a stand-alone neobank. You get to make all the decisions independently. However, you need to do the heavy lifting by yourself. If you don’t go it alone, there are several affiliation options available; you could link with existing banks as their subsidiary or a partner, or you could become a subsidiary of a non-banking organization.

You will need to pitch your business plan to some entity to raise capital. What entity is going to see the value proposition you present to them and the market? Are venture capitalists, banks, or non-bank organizations your best fit?

Integration

There are many advantages to being a stand-alone neobank. You get to make all the decisions independently. However, you need to do the heavy lifting by yourself. If you don’t go it alone, there are several affiliation options available; you could link with existing banks as their subsidiary or a partner, or you could become a subsidiary of a non-banking organization.

You will need to pitch your business plan to some entity to raise capital. What entity is going to see the value proposition you present to them and the market? Are venture capitalists, banks, or non-bank organizations your best fit?

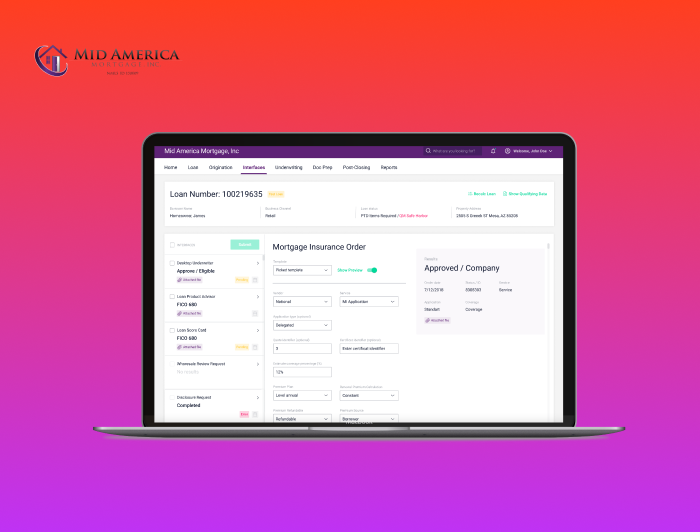

Software development outsourcing options

While building a neobank in-house is definitely an option, hiring an in-house development team usually takes tons of resources and time that you could otherwise spend on your product vision and marketing efforts. It’s much faster to outsource your neobank development to a reliable fintech development company with a good record of similar projects and deep industry expertise. This way, you’ll also get an invaluable and most up to date fintech knowledge about the trends, dos and dont’s for a project like yours.

Why NerdySoft for Your Next Neobank Project

NerdySoft is a full-service FinTech development company. Our proven track record can provide you with the guidance you need to build your neobank. We can guide you through the core decisions that establish the strategies you need for success. Using those strategies, we can select the tools and create the teams needed to design, build, and test your neobank applications.

Strategy and tools

Solution architecture is the foundation you need to build your neobank. Our solution architecture team will work with you to determine the proper hardware and software platforms to base your services on.

Teams

Your team will have appropriate members from our relevant services. Depending on your needs, the team will include project managers, software product engineers, business analysts, skilled developers, software testing and quality control staff, UI/UX design specialists, and DevOps specialists. They will build and deploy your solution as a cohesive unit using modern development and deployment methodologies and tools.

We have built multiple neobanking solutions, and our success with our various fintech clients makes us confident that NerdySoft can build your neobank for you. Please get in touch with us to find out how.

Latest Insights

Stay informed on the latest updates and trends to follow in financial services, digital transformation and software development from NerdySoft