AI in Fintech. Be the One to Change the Game

Artificial Intelligence (AI) is the technology often associated with the future. Yet, it is the instrument that emerged decades ago. The first AI models saw the light in 1954, before the Internet age. Yet, riding the wave of digital transformation, AI has become a tool not many industries can afford to avoid. And the financial sector is no exception. The global AI in the Fintech market is currently worth $11.7 billion. It is expected to reach $54 billion by 2032. Grasping the power of Artificial intelligence in Fintech stands on understanding its benefits, challenges, and use cases. Further, we’d deliver all these aspects succinctly yet with something you can apply in practice.

AI in Fintech Market Insights

The rates of AI in Fintech market growth suggest the growing demand for Fintech services in general. Besides, while this particular market develops, the entire AI market is skyrocketing as well. Bloomberg indicates the global AI market to be worth $422 billion. Essentially, the secret to AI in Fintech market growth stems from these key principles:

- AI-based Fintech apps grant a massive boost in productivity. The algorithm offers more precise financial transaction tracking capabilities and allows the processing of huge volumes of data almost instantaneously.

- Fintech now fuses with segments like Insurtech and Regtech. AI proved to be effective in all of the given sectors.

- Since 2019, the financial sector and many other industries have faced tectonic shifts linked to COVID-19. The event boosted the adoption of technologies like AI to address the changes.

These insights further drive AI in the Fintech market and show that the industry’s future is promising and bright. Yet, there are many more Fintech trends one can explore.

Who Needs Fintech AI?

Artificial Intelligence in Fintech is not the all-fits-all solution. Simply put, not all the companies operating in the industry can benefit from the implementation of AI. In such a case, there are particular areas AI in Fintech can help with:

- Fintech companies looking for ways to boost security cannot afford to miss AI. IBM reports an average data breach in the financial industry to cost about $4.35 million. AI helps to reinforce the security of Fintech and track down any suspicious activity.

- AI-based Fintech software vastly improves data processing and brings automation. These aspects boost productivity and save costs.

- Customer service. Fintech companies that need better customer support depend on AI. Customer service automation platforms use AI to provide human-like personalized customer services without additional costs.

- Insider Intelligence indicates robo-advisors managing $4.6 trillion in investments in 2022 alone. Fintech companies looking to have a piece of that pie require AI in their arsenal.

If any of the aspects mentioned earlier correlate to your business objectives and desires, you need to consider AI in Fintech.

Benefits of AI for Fintech

AI is much more than a data processing technique. When properly used in Fintech, it can bring massive benefits. To illustrate, the following are several to mention:

- Better user engagement. Ai is great for tracking user behavior. Besides, AI chatbots are vital in granting immediate feedback and user interaction. All these aspects show accurate user preferences and improve user engagement.

- Almost no customer support cost. Customer automation platforms provide 24/7 support. It means you do not need an entire customer support department, which drastically cuts costs for customer service.

- Optimized workload. Ai in Fintech automates various mundane tasks. For instance, the technology handles transaction tracking, client classifications, and regulation adhering. All these elements help optimize the workload.

- Enhanced payment security. AI in Fintech data uses top-grade encryption and protection. It manages user authentication and payment monitoring without any human input required.

- Real-time data-driven decision-making. AI processes data and generates real-time relevant insights. In addition, it can make predictions. These factors play a vital role in more accurate decision-making.

AI brings many advantages to Fintech. Yet, it is not a panacea and should be regarded as a technology still in its infancy. It means using AI for Fintech should be a process handled with caution.

Challenges of AI in Fintech

As with any other still-in-its-infancy technology, there are particular challenges one can face during AI adoption. Essentially, these correlate to the following:

- Data processing. AI handles massive volumes of data. In Fintech, it means working with a load of sensitive information. The more such information is processed, the higher the probability of its potential exposure.

- There are many regulations within the Fintech industry. Using AI as a tool means meeting new demands for local, federal, and international guidelines, which can mean additional expenditures.

- Many people still do not trust AI. You can face the challenge of your clients being suspicious of AI in Fintech and not wanting to do anything with it.

Considering the issues mentioned above when implementing AI for Fintech. Otherwise, you can find yourself in a position where technology brings more harm than good.

Examples of How to Use AI in Fintech

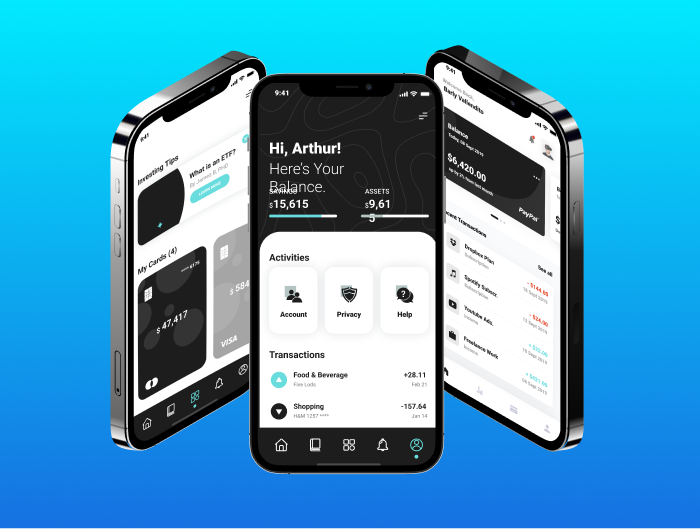

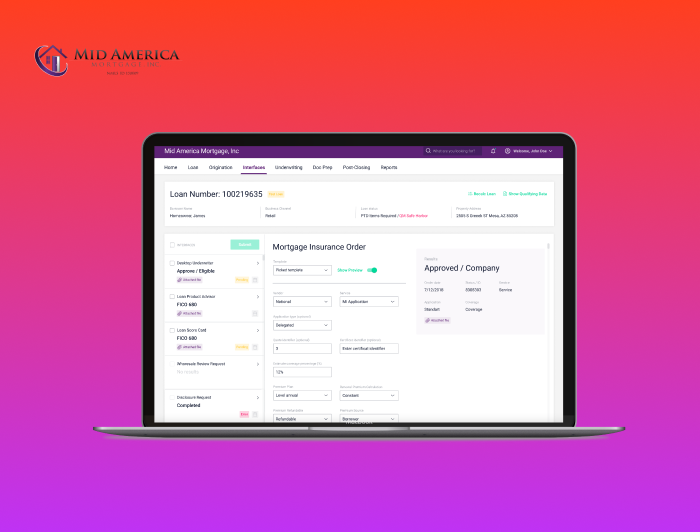

Nothing speaks best of how to use AI in Fintech than real-life use cases. While many in-demand Fintech apps use AI, several require particular attention.

- Wealthfront. It is a Fintech platform serving as a robo-advisor. The company uses AI as a part of its assets under management (AUM). It manages to make $25 billion annually.

- Erica. The Bank of America application uses Erica as an AI-based chatbot. It handles various tasks and provides users with 24/7 support and navigation. You can use the platform’s virtual assistant to manage the entire account.

- Perfios. It is an AI-based Fintech solution used by many banks. It offers top-notch data analytics and is well-recognized by behemoths like Deutsche Bank and Home Credit Finance.

- Suplari. Microsoft bought this AI-based platform in 2021. It helps clients manage expenses along with finding cost-saving avenues. Suplari replaces the entire team of analysts and a myriad of Excel sheets.

The use cases mentioned above show that AI for Fintech is up-and-running. The more companies will bear its fruits, the better solutions will emerge in the future.

Concluding Remarks

AI in Fintech is the present. It already works for the benefit of the financial industry and its clients. It comes to the point when Fintech companies cannot merely afford to pass on AI. Namely, it boosts productivity, new realms in customer support, and never-seen-before data analytics. However, sometimes it appears too good to be true. That is why you always need to double-check the usage of AI in Fintech and anticipate all the moments that can go wrong.

Latest Insights

Stay informed on the latest updates and trends to follow in financial services, digital transformation and software development from NerdySoft