How to Develop a Certification Ready Fintech App: Standards and Requirements

Fintech mobile app development always deals with money and data storage, there are plenty of regulations a fintech app has to comply with. Compliance with these regulations is vital to the success of your fintech app. Not only does it help you avoid penalties and sanctions, but it also makes your financial app considerably safer.

This fosters user trust, resulting in a better user experience and, ultimately, app success. As a result, it’s best to view compliance as a necessary component of your success rather than just another item to check off your to-do list. The following are the most crucial rules of how to develop a fintech app.

Content Outline:

What Are the Requirements for a FinTech App to Operate on a Market

Types of Requirements for FinTech Apps

Data Governance

Data governance refers to a company’s ability to handle its data effectively. It encompasses a wide range of tasks that guarantee data is accessible, useable, and consistent. The main concerns of data governance as a requirement for fintech apps are security and privacy. Data security and privacy are two of the most tightly regulated components of the financial business around the world.

Based on the World Bank’s database, over 200 countries have fintech-related legislation on data protection and privacy. The EU’s General Data Protection Regulation (GDPR) is one of the most well-known data protection laws. The Consumer Data Right (CDR) in Australia and the California Consumer Privacy Act (CCPA) in the United States are two more fintech standards worth looking into.

Know Your Customer (KYC) Compliance

Any company providing financial services must comply with the Know Your Customer (KYC) regulation. Almost all banks and financial service providers, such as insurance and lenders, are required to comply with it.

Each region has its unique KYC standards, which must be met to comply with anti-money laundering (AML) laws. KYC is governed under the Banking Secrecy Act (BSA) and, to a lesser extent, the US Patriot Act in the United States.

The purpose of KYC is to validate the user’s identification and risk profile. It guarantees that they are legitimate organizations rather than crooks impersonating them. The fundamental purpose of KYC is to prevent fraud and money laundering schemes.

Cybersecurity Requirements

According to CheckPoint Research, there were up to 50% more cyberattacks in 2021 than in 2020, making cybersecurity measures more critical than ever. Many fintech organizations are lax due to a lack of stricter cybersecurity rules. Because hackers are aware of this, they are more likely to attack fintech apps.

Financial systems have been the target of several attacks. In some cases, cyberattacks are triggered by a third-party provider’s breach rather than the app itself. It emphasizes an important point: your app’s cybersecurity should include the entire ecosystem. From your servers to your network endpoints, everything must be secure. Cybersecurity’s seven levels are a fantastic approach to achieving this.

PCI-DSS Compliance

Your fintech app is likely accepting credit cards for tasks like cashing in or sending payments. In this case, you’ll almost certainly need to follow Payment Card Industry Data Security Standard guidelines. PCI-DSS is a standard that oversees credit card transactions and ensures that they are processed securely and safely.

Non-compliance with the PCI-DSS might result in substantial fines from their credit card processor. It’s also worth noting that simply not complying with PCI-DSS is enough to result in a consequence — a data breach isn’t required.

Electronic Fund Transfer Act (EFTA) Compliance

The Consumer Financial Protection Bureau (CFPB) oversees the Electronic Fund Transfer Act (EFTA), which supervises electronic money transfers using debit cards, ATMs, and point-of-sale terminals. Its objective is to safeguard users in the event of an error, such as when funds are moved incorrectly to another account.

To comply with EFTA, you must provide users with particular information about their fund transfer transactions. It basically lays out the ramifications of unauthorized transactions and what happens in the event of an error.

Before we get into fintech compliance and certification, let’s look at its origin and goals. Let’s start with an explanation of what it includes. FinTech compliance refers to following the rules that govern innovative business models and financial technology. These rules aid in the protection of customers’ interests and the capital of investors.

Regulatory guidelines and certification for fintech apps are aimed to mitigate three main risks.

- Data breaches

- Money laundering

- Cyber attacks

Preventing Data Breaches

One of the most critical aspects of developing financial technology is risk assessment and data breach prevention. When regulatory organizations identify a data leak, they may be able to track down the perpetrator. In countries that are members of the European Union. Noncompliance with anti-data-leaks regulations could punish two to four percent of a company’s sales.

Anti-Money Laundering

Money laundering costs businesses and governments more than $2 trillion each year. All countries have anti-money laundering (AML) policies due to this significant loss.

Additionally, there are regulatory agencies that coordinate operations and data.

Mitigating Cyber attacks

Financial institutions are a popular target for cybercriminals. The government is concerned about both FinTech and traditional banks. FinTech-centric rules are in place to assist in protecting consumers’ interests.

How to Design & Develop a Certification-Ready Fintech App

Proper Planning and Preparation Process

Product Discovery

Before you decide to develop a fintech app, you need to confirm the viability of your fintech idea. It can be accomplished through a product discovery stage. This phase is required to establish that you have a viable product concept, identify project complexity to estimate overall costs, and examine potential hazards. This stage helps you and your fintech app development team plan for a seamless and timely product launch while keeping all stakeholders on the same page.

Identifying Must-Have Certifications for the Niche and Location

When launching a finance app, you need to determine which fintech sector you’ll concentrate on first (digital banking, insurance, loan lending, etc.), as every niche has its must-have fintech requirements and certifications. Moreover, every country and even state has different legal requirements and certifications for the fintech to operate on the market.

Software Infrastructure

Secure Infrastructure

A fintech app is usually a part of a larger ecosystem that includes banks and other fintech platforms. Sensitive data is constantly flowing to and from these systems due to all of this interconnectedness. Hackers can readily intercept that traffic unless you have strong infrastructure protection.

Therefore, simple security measures are insufficient to assure a secure user experience. You should consider enhancing the overall security of your fintech app infrastructure. The seven levels of cybersecurity are one of the most acceptable ways to do this. It’s a method that functions like a medieval castle, with each layer offering a defensive measure.

Identification, Authentication, Authorization

Authentication, and access control are the easiest ways to get into a financial app. That’s why relying on a username and password to log people into your app is never a good idea for a fintech app builder. There are two other standard techniques of authorization in mobile financial apps: biometrics and two-factor authentication (2FA).

Data Encryption Techniques

One of the best and most effective ways to protect your users’ data is to employ data encryption. It should be a cornerstone of your financial app’s security strategy.

Given the necessity of encryption, it’s perplexing that not everyone places enough emphasis on it. Simply put, data should be encrypted before being stored in a database. It can be done with the Advanced Encryption Standard (AES), which is the gold standard for storage encryption.

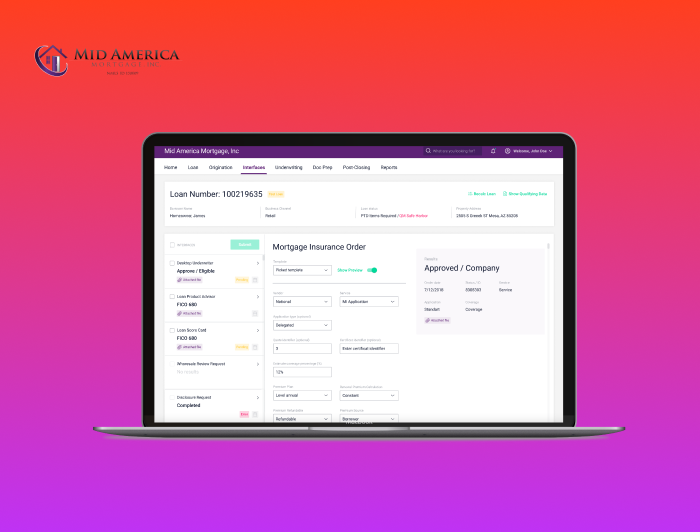

Integration

Your loan software cannot be an island. It needs to interact with other organizations and service providers. Start the design process by answering the following questions:

- Should you capture information from major credit bureaus?

- Should you accept payments from a variety of service providers?

- Should you integrate customer relationship management (CRM) platforms to manage marketing client campaigns?

- Should you integrate with your accounting systems?

- Should you integrate with collection and credit organizations if you need to proceed to a collections process?

2. Lack of Expertise

- Should you capture information from major credit bureaus?

- Should you accept payments from a variety of service providers?

- Should you integrate customer relationship management (CRM) platforms to manage marketing client campaigns?

- Should you integrate with your accounting systems?

- Should you integrate with collection and credit organizations if you need to proceed to a collections process?

3. Higher Prices

There is no reason to dwell too much on this one, as this is a complete hoax. There is actually no explanation to how this superstition emerged on the surface, while facts remain facts. The average hourly rate per one developer in the United States is $150; in Europe, it amounts to €150. Meanwhile, if we’re talking about Asia, Africa, and Eastern Europe (where many countries are still not part of the European Union), the damage will be approximately $75. It seems like the difference is even more than tangible, given that the quality of services might be even better.

4. Irresponsible Vendors

When you’ll hear about irresponsible vendors from outside Europe, may you ask yourself a question of how territorial affiliation can be the cause of irresponsibility? While you’re in the IT business, it is quite probable that logical reasoning is one of your core virtues. There are both responsible and irresponsible vendors within Europe and outside its boundaries. Hence, when it comes to choosing a software outsourcing company, think of their tech expertise, portfolio, and clients reviews, as this is where the grain of truth lies.

How NerdySoft’s Fintech Expertise Can Help

Advice & Consultancy

NerdySoft has robust fintech expertise to help you learn which financial technologies to use, following best practices and top fintech trends to stay ahead of the competition. Our strategic technology consulting services will assist you in validating your financial product concept, digitizing operations, lowering costs, and using cutting-edge technologies.

Software Architecture Design

NerdySoft is a full-service software development company that specializes in Software Product Engineering. Whether you want to start developing a custom E-commerce platform from scratch, expand your in-house developer team or improve the features of your existing solution, we will turn your E-commerce ideas into a successful project.

Dedicated Fintech Development Team

NerdySoft is a full-service software development company that specializes in Software Product Engineering. Whether you want to start developing a custom E-commerce platform from scratch, expand your in-house developer team or improve the features of your existing solution, we will turn your E-commerce ideas into a successful project.

QA in Preparation for Audit/Certification

Is there a more practical approach to joining the market than with a tried-and-true product? There most certainly isn’t. This is why NerdySoft provides you with our QA outsourcing services while you are preparing for your fintech app audit and certification. Our professional QA teams will find and prevent errors and bugs, guaranteeing that your fintech product is certification-ready.

Contact us to learn more about fintech app compliance and certification.

Latest Insights

Stay informed on the latest updates and trends to follow in financial services, digital transformation and software development from NerdySoft