Designing Software Architecture for Loan or Credit Software

In a world where ‘always connected’ is the new norm, competitive and effective loan and credit repair organizations need top-notch modern software to run their business. Are you running or looking to start a loan or credit repair company? Can your customers view and maintain their information on your systems with 24×7 access? Does your current system provide guided workflows to assist your agents? NerdySoft presents features and functionality you need to consider in your software architecture design for loan or credit software to make your business thrive.

Content Outline:

Software Architecture for Loan Software

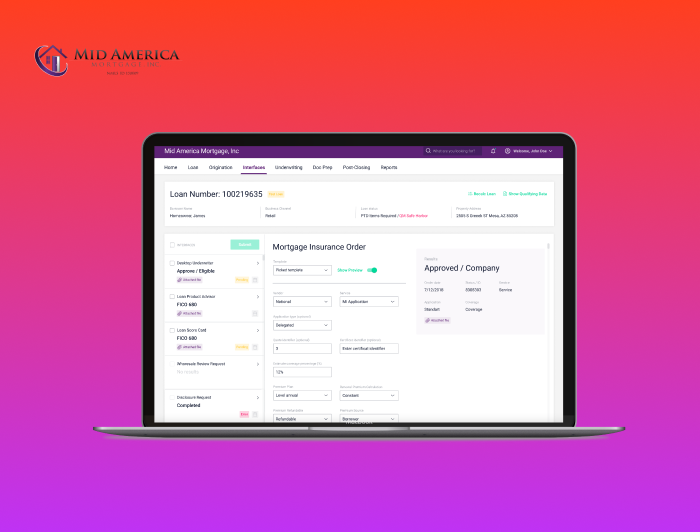

Organizations use loan software to assess the creditworthiness of clients and then extend appropriate loans at appropriate rates to meet the needs of trustworthy clients. Good loan management software covers the entire client lifecycle, from onboarding, needs assessment, and credit assessment to approval, document management, funds delivery, payment receipts, and loan completion. While supporting your organization’s needs to capture information about the clients, you need to provide a positive experience to ensure client retention. Can your current loan software do that?

Functionality

Your agents need powerful tools to manage your risk and provide good customer service. Here are the things you’ll need to design your application for:

- Should you quickly configure new loan products?

- Should you configure workflows to guide the agents through the client’s loan lifecycle?

- Should you treat commercial clients differently from consumer clients?

- Should you have strong fraud prevention capabilities?

- Should you readily report on or analyze your data?

Integration

Your loan software cannot be an island. It needs to interact with other organizations and service providers. Start the design process by answering the following questions:

- Should you capture information from major credit bureaus?

- Should you accept payments from a variety of service providers?

- Should you integrate customer relationship management (CRM) platforms to manage marketing client campaigns?

- Should you integrate with your accounting systems?

- Should you integrate with collection and credit organizations if you need to proceed to a collections process?

Client self-service

Can your clients access your system? Can they:

- view their data,

- update their information,

- access messages from you,

- upload documents in response to your requests, or

- access your systems from any device?

Integration

Your loan software cannot be an island. It needs to interact with other organizations and service providers. Start the design process by answering the following questions:

- Should you capture information from major credit bureaus?

- Should you accept payments from a variety of service providers?

- Should you integrate customer relationship management (CRM) platforms to manage marketing client campaigns?

- Should you integrate with your accounting systems?

- Should you integrate with collection and credit organizations if you need to proceed to a collections process?

2. Lack of Expertise

- Should you capture information from major credit bureaus?

- Should you accept payments from a variety of service providers?

- Should you integrate customer relationship management (CRM) platforms to manage marketing client campaigns?

- Should you integrate with your accounting systems?

- Should you integrate with collection and credit organizations if you need to proceed to a collections process?

3. Higher Prices

There is no reason to dwell too much on this one, as this is a complete hoax. There is actually no explanation to how this superstition emerged on the surface, while facts remain facts. The average hourly rate per one developer in the United States is $150; in Europe, it amounts to €150. Meanwhile, if we’re talking about Asia, Africa, and Eastern Europe (where many countries are still not part of the European Union), the damage will be approximately $75. It seems like the difference is even more than tangible, given that the quality of services might be even better.

4. Irresponsible Vendors

When you’ll hear about irresponsible vendors from outside Europe, may you ask yourself a question of how territorial affiliation can be the cause of irresponsibility? While you’re in the IT business, it is quite probable that logical reasoning is one of your core virtues. There are both responsible and irresponsible vendors within Europe and outside its boundaries. Hence, when it comes to choosing a software outsourcing company, think of their tech expertise, portfolio, and clients reviews, as this is where the grain of truth lies.

Software Architecture for Credit Software

Consumers use credit repair software to improve their credit scores. They may do so to get a loan, credit, or lease approved or reduce the interest rates they pay. They may work using self-serve capabilities, or they may work under an agent’s guidance. Good credit software supports the entire client lifecycle, from lead management, onboarding, and credit score factor analysis to mistake correction and repayment strategies.

Functionality

The first step to improve a consumer’s credit score is to analyze why the score is low.

- Should your software automate the analysis?

- To dispute these problems, should you generate letters for the consumer and have those templates populated with available information?

- Should you maintain a library of locale and organization-specific templates so that the letters produce the desired response?

While some organizations may respond quickly and correctly, often follow-up is required. Therefore, people need to manage the lifecycle of each correction step.

- Should you provide to-do lists, reminders, and follow-up notifications for that lifecycle?

In addition to correcting issues with the credit record maintained by credit bureaus, consumers can change their purchasing and payment practices.

- Should you provide what-if modeling to help them understand the benefits of different activities? E.g., if I pay down credit card x now, how will it affect my score?

- Do you provide educational and course libraries to help them understand how to modify those practices?

Integration

- Should you import recurring credit reports from the major credit bureaus?

- Should you accept payments from various payment platforms?

- Should you integrate with CRM software to manage client marketing campaigns?

Client self-service

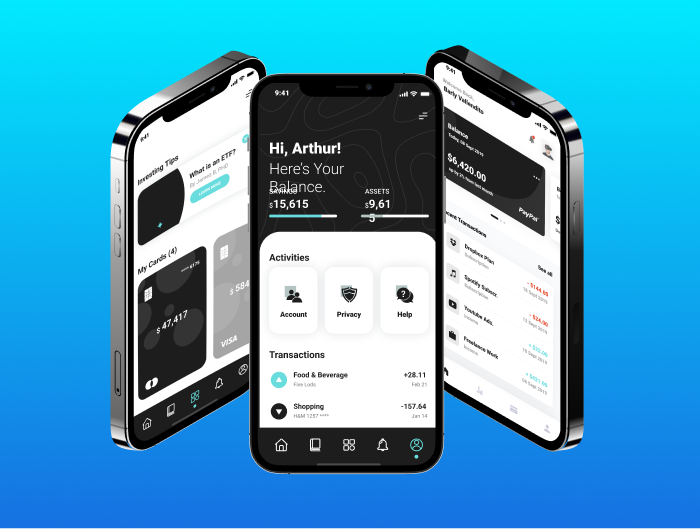

- Whether working by themselves or with an agent, does your client have the anywhere, anytime, any device access they need?

- Can they work on improving their score on their phone on the train on the way home from work?

Extend Your Systems

If your systems don’t have the functionality, integration, and client self-service capabilities you want, there are various ways to refine them. The options can range from evolutionary to revolutionary, depending on where your systems are now, where you want them to be, and how fast you want to transform them. Here is an example of a more revolutionary project building virtual banking software. Interested in discussing your technical options with experienced fintech software architects? NerdySoft experts will work with you to find the path from where you are to where you want to be.

Software Architecture Design Service

To get to where you want to go, we need to worry about the current software foundation and the one you need. Suitable software architectures can create appropriate foundations for us to build your new systems. Like a house, those systems will not perform well or last long without a good foundation. Here at NerdySoft, we offer a solution architecture service specifically to design and plan for a scalable software architecture best suited for your loan or credit software before the development process. Here are the specific areas we consider:

Accessibility

- Do we need to provide multi-platform support?

- Is it limited to clients, or does it include staff and management?

- Does access need to be multilingual?

Integration

- Do we need to provide multi-platform support?

- Is it limited to clients, or does it include staff and management?

- Does access need to be multilingual?

Scalability

- Are you providing access to 10’s, 100’s, or 10,000’s of clients and staff?

- Is that an immediate load or a long-term forecast?

Reliability

- Is 24x7x365 access required with 99.99% availability or does lower availability work?

- How reliable do the integrations need to be? Is 99% good enough?

Security

- What portions of your system need to be encrypted to access?

- How complex are your role-based access control (RBAC) rules?

- Is RBAC at the function, screen, field, or record level?

Extensibility

- How flexible does your system need to be?

- Are user-defined fields required?

- Do you need to define custom workflows?

- How complex do your product/service definitions need to be?

Maintainability

- Can we use existing open-source or commercial components for some functionality (e.g., workflow engine)?

- How do we best assemble custom services and components to be reusable?

- How do we isolate platform-specific UI code from the main source code line?

Key Considerations for the Loan and Credit Software Development Process

As clients become more computer savvy, ease of use and accessibility are critical for client satisfaction and retention. Easy things need to be easy to do, and they need to be available anywhere at any time.

When agents are working with clients, consistency is essential. Guided workflows are a highly effective way to direct one agent through helping the client, but they also enable an interchangeable team to work together for the client’s success.

Management reporting and data analysis are essential to running your business. What are the profiles of your best/worst clients/employees? What are your most effective/profitable services/products? How consistently are clients being treated?

Building in-house versus outsourcing

There are many moving parts in making a powerful modern loan and credit software. Some organizations have the depth and breadth to take on a significant development task if their current software falls short of what it needs to be. However, most organizations don’t have the depth and breadth to dedicate a large multi-disciplinary team to the project. Therefore, for most organizations, outsourcing the development makes the most sense. Do you have the confidence that your IT organization can be successful, or do you need help from experienced outside experts?

Why NerdySoft is good for outsourcing your loan and credit software development?

NerdySoft has the experience and expertise you need to build the loan or credit software you require to succeed. We can work with you to assess your needs and establish an action plan like we already did for multiple loan management platforms. Based on that plan, we can confirm the appropriate software architecture and build the team of experts in the required spheres like software development, UI/UX design, or others. Based on documented requirements, we will create a release and project plan to direct us to the end goal. Our depth and expertise in software testing and quality control will ensure that the developed components and products meet your requirements.

NerdySoft is a dedicated software development team provider specializing in Software Product Engineering. We have vast expertise in E-commerce, CreditTech, HealthTech, and FinTech. Our CreditTech team can address your challenging tech problem. Talk to our experts to discuss the details.

Latest Insights

Stay informed on the latest updates and trends to follow in financial services, digital transformation and software development from NerdySoft

Services

Technologies

Menu

Latest Insights

Stay informed on the latest updates and trends to follow in financial services, digital transformation and software development from NerdySoft