How to Build a Fintech App?

The birth of the Internet has redefined the world of banking and financial services. Decades later, Fintech services are still booming, and there is no end to the process in sight. Finance Yahoo anticipates the global Fintech market to reach $936 billion by 2030. It is an almost eightfold rise from the $115 billion value of the market in 2021. In such a context, operating in the Fintech sector offers financial gains. One of the reliable ways to do so is to build a Fintech app. Further, we’d explore how to build a Fintech app in simple steps to bring value to clients and vendors alike.

Mobile Fintech in a Nutshell

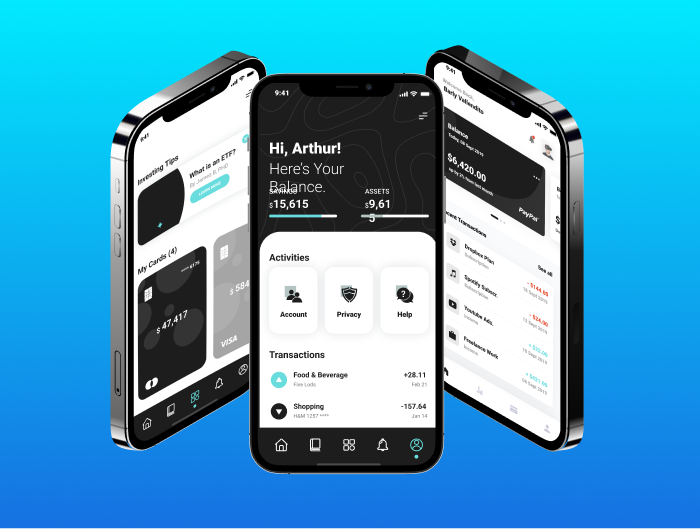

Software development companies deliver Fintech apps to offer users a simplified and interactive way to deal with financial transactions. The most recent report dated July 2022 suggests about 6.64 billion smartphones worldwide, which is expected to grow to 7.33 billion by 2025. Simply put, there is enough work for Fintech application developers. With mobile Fintech, users can make financial transactions and much more. To illustrate, a Fintech app can be used to get online loans, engage in budget control, see analytics, and purchase insurance.

Most recent trends in mobile Fintech find ways of coupling Fintech apps with technologies like blockchain and Machine Learning (ML). These instruments help integrate top-grade security, decentralize financial processes, make the entire process seamless, grant access to cryptocurrencies, and improve risk assessment capabilities. As a result, mobile Fintech is the prospective realm that innovates and develops to meet the criteria of the digital age.

Why Build a Fintech App?

Harvard Business Review suggests that Fintech can help companies streamline their financial operations. In reality, building a Fintech app offers many more benefits. These include the following:

- Cash flow optimization. With a Fintech app, users can effectively manage their financial transactions. They can see where their funds are moving and receive a report on each cash flow operation.

- Real-time analytics. Employing ML, companies can use Fintech apps to analyze vast volumes of data on user behavior. It grants a precise image of a client, which is the foundation for offering more personalized services.

- Cost reduction. Fintech apps help reduce or almost avoid bank fees. Besides, with tools like call center automation, you can have AI-based chatbots managing your customer support. It means you don’t need to hire customer support representatives.

- Return on investment (ROI) boost. A good Fintech app attracts customers. Yet, you need a user-friendly interface and flawless app functionality to achieve that.

Building a Fintech app can bring massive benefits. However, to know how to develop a Fintech app correctly, there are certain steps to follow.

Steps to Build a Fintech App

The best Fintech apps do not appear out of thin air. They are developed and deployed with care and scrutiny. Knowing how to develop a Fintech app directly depends on meeting certain requirements. The following is the step-by-step process allowing you to build a Fintech app that will stand out.

Step 1. Choosing an app’s type

The starting point is to select the type of Fintech app you want to develop. While there are particular Fintech mobile apps with the most demand, it is important to consider these options:

- Payment app

- Mobile banking app

- Loan app

- Investment app

- Insurance app

- Regtech app

The fintech app-building process starts with choosing what your app will deliver in terms of value and services.

Step 2. Researching the niche

The second phase is all about research. Define what issues your product will solve. In addition, explore why users will use the app, how it will generate revenue, and what competitors in the niche market offer. For instance, entering the P2P payment segment is extremely hard due to players like Google Pay dominating it.

Step 3. Selecting the right tech

The next step is to choose the right tech stack. To know how to build a Fintech app, you must know what technologies to use. These are the elements to consider:

- Programming languages: Swift for iOS and Kotlin for Android.

- Software development kits (SDKs): Apple XCode and Android Studio.

- Databases: MySQL and MongoDB.

- Frameworks: js, React Native, and Flutter.

These are the key tech bases to cover.

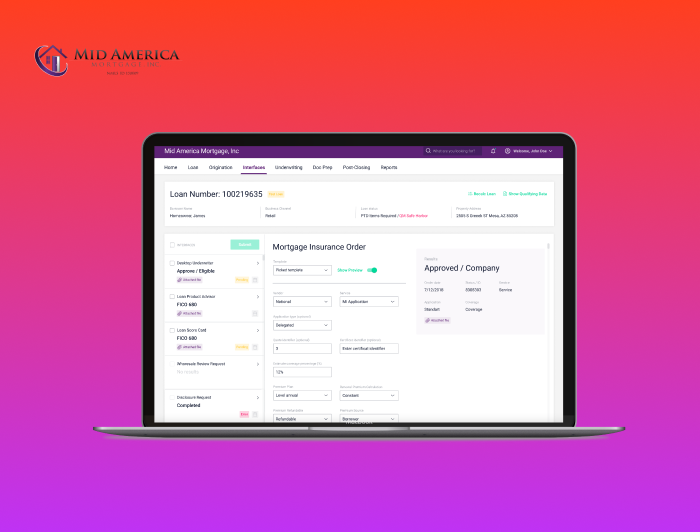

Step 4. Covering legal aspects

Developing a certification-ready Fintech app is another major step to consider. Forbes offers a list of crucial Fintech legal regulations to keep in mind. When developing a Fintech app, check U.S. Federal Trade Commission (FTC), Electronic Fund Transfer Act (EFTA), General Data Protection Regulation (GDPR), ePivacy, and PCI DSS security standards.

Step 5. Gathering development team

With legal matters covered, proceed to gather a development team. Get experienced software developers, engineers, and QA testers who have already worked on building a Fintech app. What is more, choose between in-house and outsourcing options. It all depends on your needs and resources.

Step 6. Choosing the API

In mobile Fintech, most products use APIs. In such a case, use Plaid API to connect the app’s user interface to bank accounts. Stripe API is one of the best for storing credit card information. Experian API can be used to get credit ratings. Slack API is the type of API to use for great customer support.

Step 7. Engaging in development

With everything put together, it is time to start the development process. When building a Fintech app, create wireframes, develop a prototype, test it, collect feedback, design a user interface (UI), and test it again. If all the tests come without bugs, develop a minimum viable product (MVP) and later convert it into the end-product with a back-end ready.

Step 8. Testing

After the product is up-and-running, perform functional, performance, and security testing. Don’t forget to reinforce infrastructural security with transport layer security (TLS), rule-based authorization, and end-to-end encryption protocols.

Wrapping up

Let’s double-check everything. To know how to build a fintech app, you need to understand the context, namely, understand why you are doing that in the first place. Then, you choose the type of app to develop, research the niche market and choose the proper tech stack. After that, you address legal matters, assemble a team of developers, and determine required APIs. Finally, it is time to start the development process and finalize a lot of testing. Following these simple steps is an easy way to develop a Fintech app without needless pains.

Latest Insights

Stay informed on the latest updates and trends to follow in financial services, digital transformation and software development from NerdySoft