How to Create a Money Transfer App?

Digital banking is booming. According to MarketWatch, the global digital banking market will reach $37 billion by 2028, up from $10.8 billion. According to Statista, money transfers and the digital remittance realm experience a compound annual growth rate of 11%, which is huge. Software development companies will get new contracts for money transfer app development.

Yet, to tap into what the market can offer, you need to know how to create a money transfer app. While this process is a complex one, there are some tips and tricks that can help explore its full potential. Let’s learn more about money transfer app development, why companies choose it and explore the core steps needed to build a top-grade money transfer app.

Money Transfer App Development in a Nutshell

In short, a money transfer app is a product using a peer-to-peer (P2P) transaction system, allowing users to make various financial transactions without using a bank or a credit card company as an intermediary. In addition, when it comes to top-performing money-transferring apps like Wise, RemitONE, and VayuPay, they are all built using similar principles.

These money transfer apps enable users to conduct multiple transactions in different languages and currencies. In addition, they offer a bunch of online remittance options you can handle from a mobile device or desktop. Usually, money transfer apps track all the transactions and keep a digital ledger where you can find all the information on money transfers. To be a top-performing money transfer app, it must adhere to the strictest security and privacy standards.

Importance of Money Transfer App Custom Development

When you have a top-performing money transfer app, you get access to some notable advantages. People often want to know how to create a money transfer app.

- When creating a money transfer app, you have a business focus. Besides, this product will serve a particular market niche and meet user expectations. Put all these into the software.

- Great scalability. As your business grows, your money transfer app can grow accordingly. Customer app development involves exploring future user needs and changing market demand. As a result, you can plan for new features and prepare for the changes to get a competitive advantage.

- Profit-making opportunities. With productivity and scalability comes profitability. When developed properly, a money transfer app can be a game-changer. Besides, you can always sell such an app to some other organization.

These advantages make money transfer app development appealing. However, to get the product’s full potential, you need to know what particular features it must come with. So, let’s focus on this question now.

Must-Have Features When Creating Money Transfer App

To create a money transfer app, plan to integrate these must-have features:

- P2P transfer feature enabling the app to make transactions between a sender and a receiver.

- Bill payment feature allowing users to handle utility bills and phone top-ups.

- Ewallet feature to have user funds stored and accessed.

- Expense tracking for easier money management.

- Notifications to keep users updated on money sent or received.

- Currency exchange feature to help users work with different currencies.

- International remittance feature allowing to send money abroad.

- ID-checking procedure and two-factor authentication to protect both parties involved in a transaction.

- Integration with various platforms and banks.

- A multilingual user interface to expand the pool of users.

- Customer support to help users deal with any issue or error.

Suppose you want to know how to create a money transfer app. In that case, you need to work around the features mentioned above first and understand how they can be integrated into the money transfer app development.

Important Banking API Providers

At this point, we know why Fintech API companies invest in open banking in addition to some other top trends in the industry. Moreover, we understand what drives the technology and why it is vital to take care of security when appealing to banking APIs. Now, it is time to focus on some notable open banking API providers in the industry.

- Platformable. The founder of this open banking API provider, Mark Boyd, translated his extensive industry experience into specific value-based services. In the Open Banking APIs State of the Market Report 2022, the provider argues on the importance of compliance and suggests how open banking can help address issues related to external events, like COVID-19, and internal events, for instance market recession.

- A significant investment banking company, namely Citigroup, managed to offer its distinct open banking API provider. CitiConnect API is the company’s instrument to process over one billion API calls across different channels. It is an example of how the factor of products can be used to offer services at a broader scale. Most notably, the surge in API calls was during the COVID-19 pandemic. It shows open banking API is an excellent tool for boosting operational efficiency through a scope of greater interoperability.

- One should mention Nordigen as a distinct European open banking API provider when moving to another continent. Essentially, the provider gets a user’s consent and can access the bank account numbers and see historical transactions. It opens clients an opportunity to manage financial transactions across different European banks.

- io. This open banking API provider works with various financial institutions and payment systems to grant users a direct bank payment method. Moreover, the provider focuses on data aggregation tools for its clients. One of the business’s core objectives is to make financial transactions more secure and reduce fraud by making APIs protected with top-grade encryption standards.

These banking API providers are frontrunners in the open banking industry. They ensure clients can use financial services across channels and ensure they are secure and seamless.

Steps Toward Money Transfer App Development

Now that we’ve covered most of your needs to know about money transfer apps and their importance, let’s proceed to the main course – steps required for money transfer app development:

Step 1: Conceptualization and features selection

The first step in money transfer app development is conceptualization. You need to have a grasp of what type of value your product will bring, in what market it will operate, and what user needs will meet. Next, it entails developing a set of features it will have. Before this step, you need to have market research, know your budget, and double-check the availability of team resources.

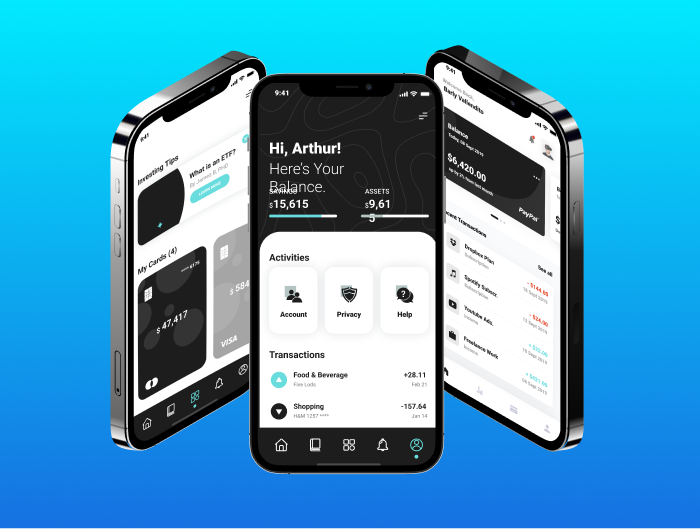

Step 2: Designing UI/UX

After you have your concept and features, it is time to work on UI/UX. It ensures a smooth look and user experience. During this phase, designers have different mock-ups of your future app. These can be tested on user-friendliness and compatibility with different devices. As a result, your team chooses one particular design and proceeds to the next step.

Step 3: Selecting a product development method

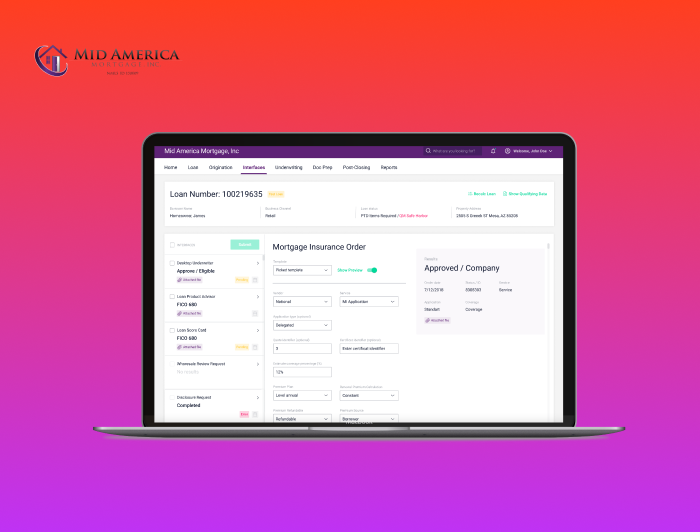

With the concept, set of features, and UI/UX design at your disposal, you need to choose how your money transfer app will be developed. You have three options, in-house development, outsourcing, or a cloud-based SaaS fintech solution. You need to know the pros and cons of each one and choose accordingly. In-house development is the most expensive yet allows the creation of the app with the most features. In turn, outsourcing is cost-effective, while you don’t have full control over the development process. Finally, you can also select between different banking API providers. So, choose wisely.

Step 4: MVP development and testing

After selecting a development option and deciding on the payment system architecture, it is time to work on the Minimum Viable Product (MVP). In short, it is the first iteration of the money transfer app you can test. This phase shows all the bugs that need to be fixed. Moreover, it indicates whether what you planned worked out exactly the same in practice.

Step 5: Product release and maintenance

Finally, after all the testing, you engage in product release. It is time for your marketing to shine and make sure people know that your product is now available.

Bottom Line

So, how to create a money transfer app? First, develop the concept, decide on the features it will have, design its UI/UX, choose the development approach, build an MVP, test it, and release the product. Yet, you need to understand that releasing the money transfer app is not the end. To keep your app running, you should maintain it properly and regularly update it. At this point, creating a money transfer app is a challenging process. Yet, the process will be much more straightforward than we’ve shown above.

Latest Insights

Stay informed on the latest updates and trends to follow in financial services, digital transformation and software development from NerdySoft