How to Create a Trading Platform: Ultimate Guide

Building a trading platform from scratch can be a complex task involving incorporating business and technology involvement. While there are a few trading platforms already available, businesses can look forward to building a trading platform of their own. With that purpose, custom trading platforms can be utilized in modern fintech solutions or released under the multi-app projects’ umbrella. If you’ve ever wondered how to build your own trading platform, this guide will cover the basics, from validating your idea to choosing a tech stack. Below, you’ll find out about key considerations, planning the features, and picking the technology stack. Whether you’re a seasoned professional or just starting in this niche, this article will provide enough information to engage with trading platform development.

Step 1: Understanding the Market and Your Audience

It’s crucial to retrace your steps and work hard to understand the market of trading platforms. With the online trading platform market project to reach $18.4 billion by 2031, the potential for this market is self-explanatory. For that reason, consider factors such as age, income, investment experience, and investment goals to help you identify your target market. This information will inform the features and design of your platform, as well as your marketing strategies. Once you have identified your target market, it is vital to understand their needs and preferences. For example, do they prefer a simple, user-friendly interface, or are they looking for advanced trading tools and market data? Understanding what your target audience is looking for will help you make informed decisions about the features to include in your platform.

It is also essential to assess the competition when building a trading platform. Research other trading platforms in the market and identify their strengths and weaknesses. Consider how your platform will be different and what it will offer that is not currently available. This information will help you make informed decisions about the features and design of your platform and will inform your marketing strategies. When conducting a detailed business analysis, you’ll get to map out areas where your custom app can succeed, such as lower fees, custom trading algorithms, or numerous payment gateways.

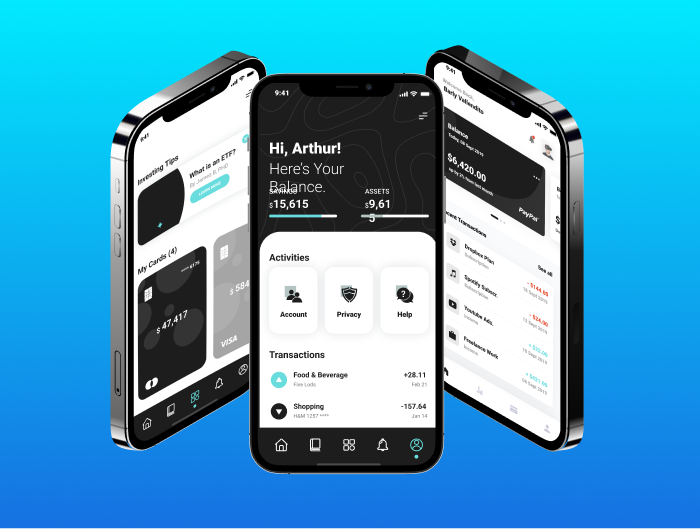

Step 2: Planning the Features of Your Trading Platform

On top of that, when planning the features of your trading platform, you should consider what is essential for your target market. The following are some of the most common functionalities that should be included in any trading platform:

- Portfolio management allows users to track their investments and manage their portfolios in real-time.

- Real-time market data provides users with real-time data on financial markets, including prices, news, and analysis.

- Trading tools include tools to help users make informed investment decisions, such as charting and technical analysis tools.

- Secure and varied payment methods are must-have options for securing funding and withdrawing from accounts.

- Customer support includes options for customers to contact customer support, such as live chat, email, or phone support.

When asking yourself how to start a trading platform, consider carefully planning how your features will impact the feasibility and implementation costs. These factors include the costs of development, the ongoing costs of maintenance and support, and the impact on the overall user experience. Evaluating the feasibility and costs of each feature will help you make informed decisions about which features to include in your platform.

Step 3: Choosing the Right Technology Stack

When building a trading platform, choosing a technology stack that will support your platform needs is necessary. The following are some of the critical considerations when selecting a technology stack:

Scalability. Your platform should be able to scale to meet the needs of your growing user base.

Performance. Your platform should be able to handle large amounts of real-time market data and provide a fast and responsive user experience.

Security. Your upcoming trading platform should be secure and protect user data and transactions. Also, it has to include the latest fraud detection and prevention strategies.

Integration with existing systems. Your platform should be able to integrate with existing systems, such as payment processors (Visa, MasterCard, PayPal, etc.) and market data providers (Yahoo Finance, Finage, IG Trading).

Review the available development team options if your in-house team cannot handle the chosen technology stack. When evaluating potential candidates, consider their experience in building financial applications, their track record of delivering successful projects, and their ability to communicate effectively with you and your team. An important note on the technology stack is that it can vary depending on your features, operating systems, data storage nuances, and other factors. The development process should also capitalize on international security standards, choosing a suitable development approach, banking API integrations, and numerous iterations of stress tests.

Step 4: Develop and Release Your MVP

Most importantly, this step comprises developing the trading platform and integrating its core features into the MVP. Your product’s first version should imply various essential elements and deliver the promised functionality. Once you have a rough platform version, conduct a range of stress tests to determine if the trading functionality is operating correctly.

Concerning the release, most trading platforms are now stored and operated by one of the major cloud providers, such as AWS, GCP, or Azure. Your development team should ensure that the live server is live and kicking and is ready to host the MVP version of your trading platform. During this stage, you can involve particular user groups to test the product’s functionality and provide feedback on the app’s usability. Even building an MVP requires a comprehensive understanding of the financial markets, your target audience, and the technology available to create a platform that meets their needs.

Summary

In conclusion, building a successful trading platform requires a combination of financial expertise, technology savvy, and effective marketing strategies. It is essential to conduct thorough market research, choose the right technology stack and development team, and ensure regulatory compliance and security. With careful planning and execution, it is possible to build a trading platform that provides a valuable service to users and becomes a leader in the financial marketplace.

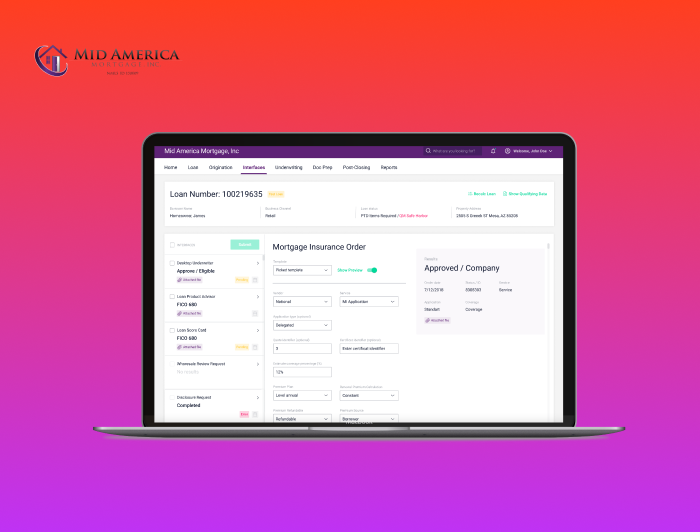

Remember that you can always make the most of custom software development services with Nerdysoft. The company’s seasoned professionals can help with anything, from payment processing solutions and technology consulting to third-party solution integrations and creating trading and exchange platforms from scratch. The team has a custom solution to every business need, which can be a much-needed helping hand when building a trading platform on your own.

Latest Insights

Stay informed on the latest updates and trends to follow in financial services, digital transformation and software development from NerdySoft