All You Need to Know about RPA in Finance

Robotic process automation (RPA) is the software technology that simplifies and manages software robot solutions. It’s technically accurate that RPA has been widely used in numerous industries, especially manufacturing. However, the demand for technology consulting regarding the RPA for finance is booming, becoming responsible for various tasks, including data entry, invoicing, compliance reporting, and more. Since this technological approach has an untapped potential for the industry, learning about it is a must. So, let’s learn more about RPA in finance, how it is used, what benefits it brings, and how to make the most of it for your project.

Evolution of Finance Robotics Process Automation

The history of RPA in finance can be traced back to the early days of spreadsheets and accounting software. During the last years, there was a growing need for financial software that could automate tasks and processes. RPA technology was developed in response to this need and has become an essential tool for many finance professionals. RPA software is used to automate a wide variety of tasks in finance, including invoicing, payments, reporting, and compliance. It has also made it possible for industry professionals to work more efficiently and effectively and has helped improve financial data quality.

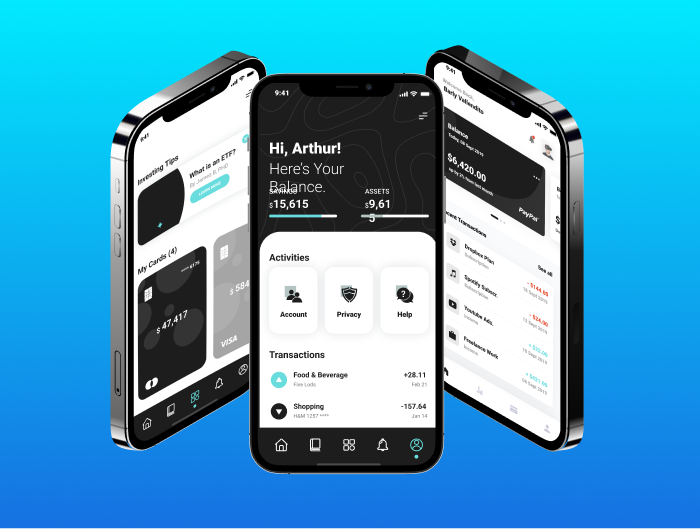

The critical feature of finance process automation is that it assists in automating various manual processes. The robotics software used in RPA is flawless in handling high volumes of recurring workloads. In the digital banking system and finance, RPA frees up more time for employees, allowing them to allocate resources for more meaningful tasks. This way, the evolution of RPA helps gain a competitive edge and turn bright financial ideas into commercial success.

Use Cases of RPA in Finance

With the global adoption of RPA financial instruments, it’s essential to understand how they manifest themselves in day-to-day operations. Let’s briefly review some of the most crucial use cases of RPA in finance one by one:

- Account payable information. Specialized software can be used to automate the accounts payable process from end to end, including extracting data from invoices, matching invoices to purchase orders, and generating payments.

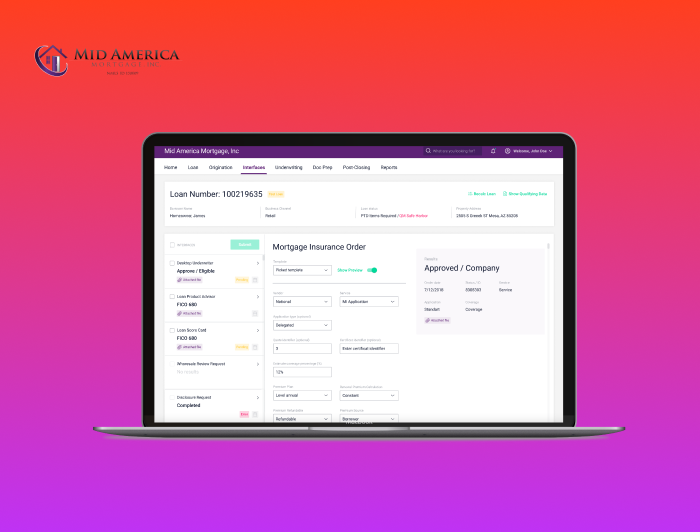

- Financial reporting. RPA is now widely used to build a framework for automation of financial reports, including extracting data from financial systems, manipulating the data in Excel, and generating final reports.

- Budgeting and planning. As the global demand for automation increases, compliance with budgeting and planning rules becomes more relevant. With this purpose, modern RPA tools can automate mundane tasks related to budgeting and planning, which are crucial for any type of organization or enterprise.

- Compliance. As a whole, it’s worthwhile to pay dedicated attention to compliance in the financial industry. Because the industry standards and regulations are robust, the automation of compliance-related tasks is a challenging objective. With RPA, it’s becoming more accessible to generate reports based on customer databases, other activities, and how internal policies match external regulations, all under a single umbrella.

- Verification. In the modern finance industry, customer verification is something you’ll likely experience when creating a new account or profile. However, customer onboarding and verification are essential to ensure your product is user-centric. Modern RPA tools have character recognition functionality, automating customer verification.

As you can see, most of the described use cases require many manual tasks and processes, including data handling, paperwork, and data extraction. The good news is that finance process automation is the next step toward ensuring organizational effectiveness and increased customer satisfaction in the long run.

Benefits of RPA Financial Tools

In the previous section, you could spot a pattern that most use cases are simplified thanks to automation. Here, let’s consider how RPA is crucial for bringing transformational change to your financial organization or institution.

- Relying on technological innovations. As the competition among financial organizations becomes fiercer, the ones with sustainable growth practices are here to stay. With RPA implementation on the go, organizations can automate a wide range of workloads, simultaneously applying the latest technological solutions. This way, financial industry representatives can ensure that their growth is sustainable and tech-oriented.

- Revamp approach to compliance. The financial industry heavily relies upon compliance with regulatory standards and industry practices. RPA, in this instance, assists in gathering and consolidating bulks of data from particular operating systems and streamlining compliance reporting. When applying the latest AI solutions, it’s also possible to filter out what data has to be stored, reviewed, and sent to regulatory firms.

- Enhance operational effectiveness. Except for the obvious boost to customer experience, it’s crucial to revolutionizing operational tasks. Automating heavy and intensive tasks, which are manual by nature, helps free up more time for analysts and other employees. In the modern finance reality, automating everything that can be streamlined is a top priority. This way, a cross-department adoption of RPA services for the accounting industry is one way to enhance operational effectiveness in the long run.

These three crucial benefits are the driving forces that will change how the industry adopts RPA tools over the next few years. Not to mention the boost to customer satisfaction, a heavy focus on automation via RPA has virtually unlimited potential for financial and accounting organizations.

Summary

All things considered, RPA is the next step toward revolutionizing the field of finance. With a vast range of use cases, from order tracking and invoicing to loan management and compliance reports, the widespread use of RPA is anticipated in the finance industry. With all this information, you might become more interested in unleashing the power of AI to automate mundane finance workloads.

If your organization requires extra help with adopting RPA for your business structure, seeking extra help might be hefty. Consider getting a helping hand from dedicated engineering teams, which can build a necessary RPA infrastructure and implement software tailored for your specific needs. Don’t hesitate to contact us for more information on RPA adoption and maintenance.

Latest Insights

Stay informed on the latest updates and trends to follow in financial services, digital transformation and software development from NerdySoft