Fraud Detection and Prevention in Banking

These days, scammers gain client data by utilizing social engineering, various hacking methods, the Dark Web, and criminal networks. According to the Financial Crime Report Q2 2021, an estimated 93% of banking-related fraud occurs online. In response, banks are increasing their investments in cutting-edge technologies such as machine learning, real-time fraud reporting, voice, face, and fingerprint recognition (biometric data), as well as so-called behavioral biometric data, which includes profiles of how customers interact with their devices and online banking tools. But as of now, this is insufficient. Continue reading this article to learn more about fraud detection and prevention strategies modern banks need to adopt.

Types of Bank Fraud

By definition, fraud in the banking system is a fraudulent conduct or breach of trust intended to get money or the property of another person. As a result, an attacker’s actions may be focused on the following:

- Banking organization The simplest and most common types of fraud include granting loans using false documentation, purposefully giving false information on applications, or even fabricating corporate activity to get a big loan for a business. As a result of such actions, the creditor is the fraud’s target and the victim.

- Bank customers. Situations frequently occur when a scammer grants a loan to a front person or completes an application using a photocopy of another person’s passport. Falsifying a stolen passport by inserting a fresh photo in it happens frequently. As a result, someone who is not even aware that a loan was obtained in his name suffers.

Read more: What Is Digital Banking: Meaning, Types, and Benefits

Bank Card Fraud and Technical Tricks

Frauds are committed in a variety of ways, ranging from peeping the pin code to sophisticated hacker attacks. If the pin code is already known, the most primitive mechanism is the theft of a plastic carrier. It is simple to peep at the victim near the ATM and then quietly take possession of the card.

Phishing

Phishing is a technique used to steal sensitive user information. Attackers typically call pretending to be bank employees and report an allegedly illegal debit or funds transfer. To cancel the operation, the victim must dial the number provided in the SMS or tell the secret combination (CVV code on the back).

In this case, only by raising financial literacy levels among the public and using specialized machine learning models are fraud detection and prevention conceivable. Unique models are developed and trained by experts, but in reality, this demands considerable resources.

Working with clients, providing training, and outlining information security essentials is a more efficient countermeasure route. Clients over the age of 50 are particularly vulnerable because they are gullible. Everyone should remember that bank workers never request CVV codes or one-time passwords sent via SMS.

Pharming

In this type of fraud, malicious code is downloaded to the victim’s device. It assists in replacing IP address information, which automatically sends the user to bogus websites. It is then prompted to enter private data that the attackers will utilize. Users of payment systems, online and mobile banking, as well as currency exchange services are the main targets of pharming. In contrast to phishing, site redirection happens automatically; the victim doesn’t need to take any further action.

Skimming

To steal money, scammers use special devices known as skimmers. They are issued in the form of a small lining for a card slot in an ATM. The skimmer copies information from the card’s magnetic stripe while the victim withdraws cash or performs other actions. Thoughtfully made overlay is difficult to distinguish even for a professional: it is thin, almost imperceptible, and made in the same color gram as ATM.

Measures Taken to Prevent Fraud

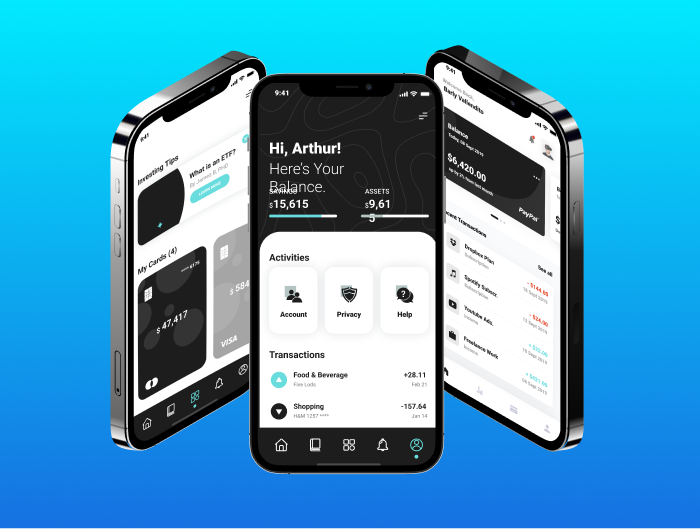

Most banks invest in measures for predicting, preventing, and detecting fraud attempts, such as two-factor or multifactor authentication, to confirm the customer’s identity. This includes asking users to provide data, such as a password, utilizing other factors, such as a text message and/or SMS code or fingerprints. Banks are also implementing technological solutions that enable real-time risk scoring and decision-making using physical biometrics (identification by voice and fingerprints, facial recognition technology).

Do Anti-Fraud Systems Work?

Scammers’ creativity cannot go unnoticed, which is why banks implement fraud control.

They employ the following methods:

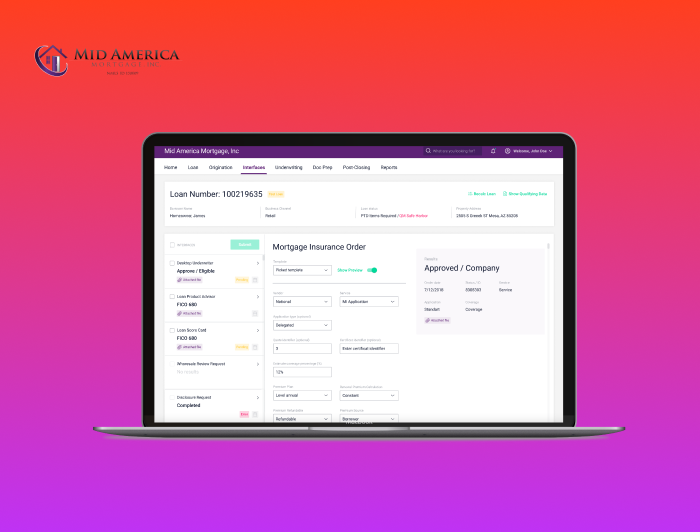

- Full-fledged software packages that detect and neutralize fraud attempts automatically. There are global systems that work with both external and internal channels, as well as highly specialized systems that only solve specific problems.

- First and foremost, there is staff training, job description improvement, and control over their observance. Technological innovations and unique systems can solve most problems, but software developers claim the benefits of a well-trained employee in a bank office or a cashier are invaluable.

Special anti-fraud solutions are being developed to stop fraud for good. According to the abundance of indications, each one is categorized as either internal or exterior, universal or business-oriented.

As experience demonstrates that these solutions provide the most incredible benefits, there are an increasing number of transaction monitoring systems on the market. Instead of attempting to eradicate the adverse effects of such tampering, it is much simpler to spot a possibly fraudulent transaction among the hundreds of thousands that travel through the system every day.

Final Words

Even though banking fraud gets worse every year, there is still a market for countermeasure solutions. The majority of modern banks use software tools designed to combat fraud today. These systems enable the speedy fraud detection and analysis of internal and external elements. Continued investment in cutting-edge technologies is required to fight fraud risks, including robotics, machine learning (artificial intelligence)-based operations monitoring, biometrics, fintech-related innovative software, and other tools for more active use of data from social media and open sources.

Latest Insights

Stay informed on the latest updates and trends to follow in financial services, digital transformation and software development from NerdySoft