How Banking as a Service Changes the Finance Industry

Banking as a Service (BaaS) is a new model of banking that is becoming increasingly popular with banks and financial institutions. In this model, banks offer services to other businesses, organizations, and individuals through an API or a different interface. It allows banks to focus on their core competencies while providing access to services to a wide range of customers. While the technology is still in its early stages, its massive adoption in fintech is just a matter of time. With this in mind, it’d be wise to review what this technology is about, what benefits it entails, and how to find a reputable BaaS provider.

What is Banking as a Service?

What is BaaS? This question has become more popular over the last few years, with a global demand among customers for choosing alternative bank providers. For instance, the Deloitte report specifies that 30% of customers are considering switching banks. If we return to answering the initial question, the BaaS model refers to providing banking products to non-bank third parties. Compared to the alternatives, one of the significant advantages of this approach is how it benefits both financial organizations and their customers.

For digital banks, BaaS can help expand their reach and address new markets without incurring the costs of building and maintaining physical infrastructure. For customers, it provides access to a wide range of banking services without the need to visit a bank branch or use a bank’s online banking portal. The BaaS model is still in its early stages of development, and several challenges must be addressed before it can truly become mainstream. Nevertheless, it represents a potentially disruptive force in the banking industry and one that is worth watching closely.

BaaS Benefits and Use Cases

While BaaS is still developing and finding ways to become a mass-adopted solution, reviewing its crucial perks is a must. For this reason, it’s more accurate to check BaaS benefits for customers, enterprises, and, of course, banks. Let’s start by taking a closer look at how customers will benefit from this technology:

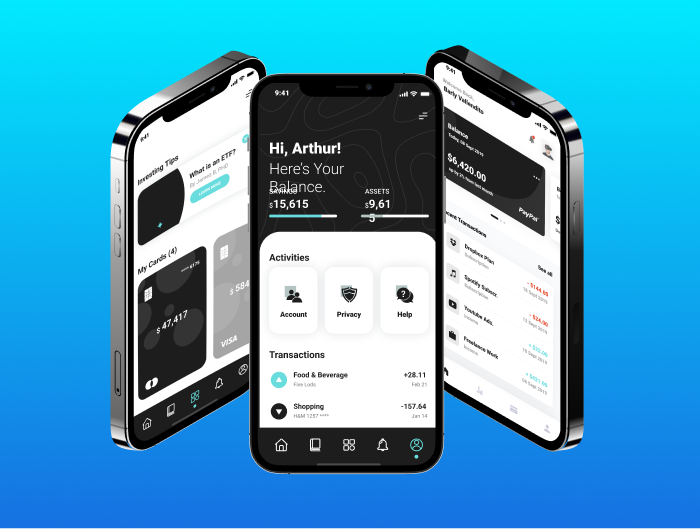

- A more diversified choice of services. The good news about BaaS for customers is an option to have a wider choice among various financial services. Since the business logic behind BaaS is that organizations seek customers, enterprises aim to deliver operational excellence. One prominent example is the introduction of personalized features, which are virtually non-existent in conventional banking systems.

- User experience enhancement. Technically, the traditional banking system looks old-fashioned, especially from the user experience standpoint. An option to get all required services in just a few clicks, ranging from loans to nuanced transfers and electronic payments, is something that boosts customer experience considerably. Thanks to the BaaS functionality, it’s entirely possible for users to get a top-notch experience, which stands out from the existing market alternatives.

While it’s clear that BaaS has an untapped potential for boosting customer experience, reviewing how banking as a service providers benefit from it is relevant too:

- Banking without banking capacities. For an enterprise delivering BaaS solutions to its customers, getting all required regulations can be too much of a bargain. Thus, becoming a third-party mediator between the financial organization and the intended audience is more convenient. This way, enterprises deliver top-notch solutions associated with banking, such as payments or loans, without the need to pass all required regulations.

- Business continuity. While it’s clear that a mere integration of the third-party solution is always viable, some services rely on complex infrastructure too much. In other words, some enterprises need a digitally innovative service without completely reshaping their infrastructure from scratch. For this purpose, delivering banking solutions as a mediator is an excellent way to satisfy all customer needs without too much hassle.

And since BaaS providers cannot function without banks, they benefit from BaaS, too, forming an ultimate win-win-win solution. In particular, banks benefit from this approach by:

- Increased revenue without intense workloads. It’s common for a neobank or a modern financial institution to operate through the cloud to deliver its services. This model means utilizing the existing infrastructure to process more clients from alternative channels. Without the considerable investment for development and efforts to attract customers, delivering financial solutions is a top-notch option for a modern banking institution.

A comprehensive operational picture. Modern banks sometimes struggle to get proper feedback on their service quality. The customer journey becomes more transparent when operating under the BaaS model, allowing banks to gain valuable insights for further changes. From this perspective, financial institutions get valuable input, which can be translated into introducing more functions or fixing the existing errors.

BaaS Challenges and Pitfalls

It’s also technically true that BaaS has its range of challenges, which deserve a separate article. Still, it’s worth reviewing the issue of responsibility shift. BaaS solutions often require sophisticated integration, adoption, and maintenance. When operating conventionally, enterprises or banks have a clear responsibility map, which displays how processes are organized. It’s a must to highlight everything before shifting to BaaS or alternative models.

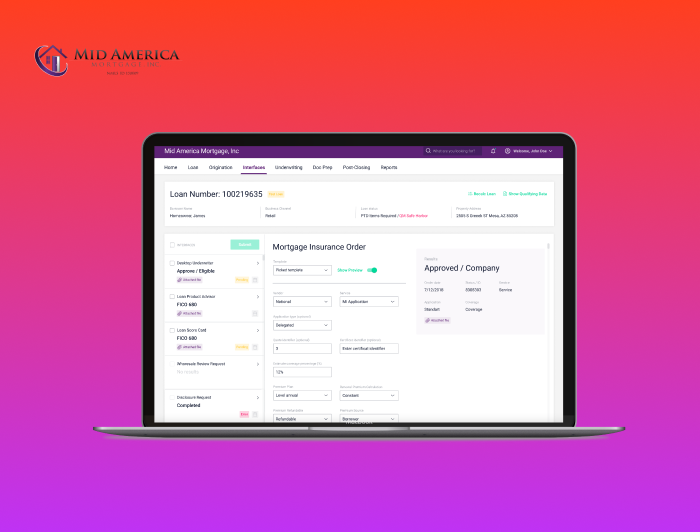

Another issue worth mentioning is finding the right service provider. Working with outdated banking infrastructure or on a legacy project is a daunting adventure that brings more pains than benefits. In this regard, hiring a dedicated engineering team competent in BaaS solutions is reasonable. With this approach, you can be confident that the chosen solution will be integrated flawlessly, without any significant concerns for your customers.

Final Remarks

As a whole, BaaS is an innovative solution that can deliver excellence for customers, enterprises, and banks, forming an ideal win-win-win scenario. While each stakeholder enjoys its post-integration benefits, this technology still has a few challenges. In particular, it’s necessary to conduct proper research and map out the responsibility, alongside finding a trusted vendor of BaaS services. Despite the minor pitfalls, BaaS can be a solution bringing a competitive edge to your company, which can become an investment that will highly outweigh the associated costs.

Latest Insights

Stay informed on the latest updates and trends to follow in financial services, digital transformation and software development from NerdySoft