Lending as a Service: The Whats and Whys

Lending as a service (LaaS) is a new fintech model that enables companies to offer lending products and services to their customers without owning or operating a lending platform. By partnering with fintech lending companies, organizations can quickly and easily launch lending products that fit their brand and customer base. Although the LaaS market is still in its early stages, it is expected to grow rapidly in the coming years. No wonder that according to Cision PR Newswire, the LaaS market is forecast to rise up to $742 million by 2027, continuously attracting new finance organizations. This article provides an overview of Lending as a service, including its key advantages and products.

What Is Lending as a Service?

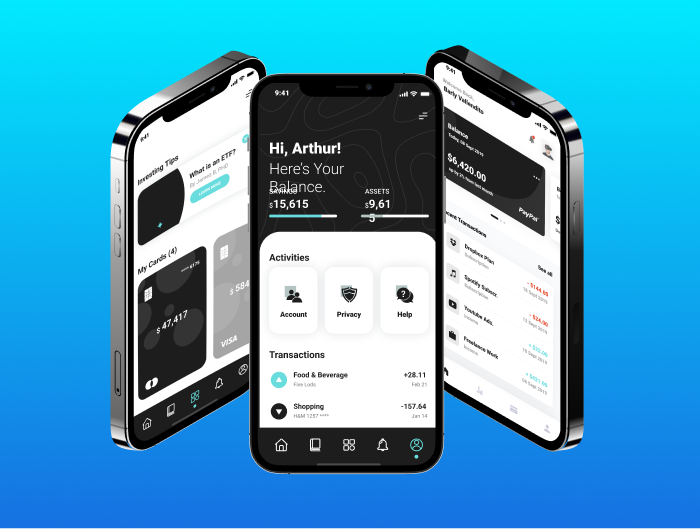

Lending as a service is a type of financial technology that enables organizations to outsource the management of their lending operations to a third-party service provider. Several factors drive the growth of LaaS, including the rise of the sharing economy, the increase in the popularity of alternative lending, and the demand for financial inclusion. Leveraging LaaS, businesses can benefit from the service provider’s expertise in multiple segments of fintech, including credit risk management, loan origination, and servicing. In addition, LaaS helps organizations reduce the cost of their lending operations and improve efficiency. LaaS provides access to a robust suite of online tools and services that streamline the lending process and offer a fast, convenient, and easy-to-use experience for borrowers.

What Are the Advantages of Laas?

LaaS is a great solution for companies that want to offer lending products but strive to delegate the development and maintenance of a lending platform. It is also an attractive option for organizations that strive to enter the lending space while avoiding the substantial investment required to build a lending platform from scratch. In addition, LaaS provides financial institutions with access to data and analytics that can help them better understand and serve their small business customers.

There are many advantages of LaaS for financial service providers. Perhaps the most obvious is that it enables providers to deliver to their customers a wider range of lending options and products. It usually leads to increased customer satisfaction and loyalty, as well as greater profits for the provider.

Moreover, LaaS can help financial service providers efficiently mitigate risks. By leveraging a third-party platform, they can outsource some of the credit risks associated with lending to a professional and experienced team. This advantage frees up time and resources so businesses can focus on operational objectives while staying ahead of the competition.

Another benefit of LaaS is helping financial service providers tap into new markets and customer segments. By partnering with a lending platform, financial organizations can quickly and easily offer their services to a wider audience without the need to set up their infrastructure.

Finally, LaaS assists organizations in keeping up with the latest lending technologies and trends. By working with a lending platform, they can deploy the most up-to-date and efficient lending processes and technologies. This approach empowers them with a much-needed competitive edge in the marketplace.

What Does the Future Hold for the Laas Niche?

The future for LaaS looks bright as the demand for these services grows and more businesses leave up to its multiple advantages. This growth is driven by the demand for faster and more efficient data processing, the increasing complexity of data, and the rising costs of traditional data processing. LaaS providers are expected to continue to invest in new technologies and services to meet the growing demand. LaaS provides a cost-effective way to outsource labor-intensive tasks, and it helps businesses improve their efficiency and bottom line. It is also a flexible solution that can be customized to meet the specific needs of a business. As the demand for LaaS grows, we can expect to see more providers enter the market, offering a more comprehensive range of services.

What Does the Future Hold for the Laas Niche?

Outsourcing companies can create a Lending as a service solution for various purposes. This number includes:

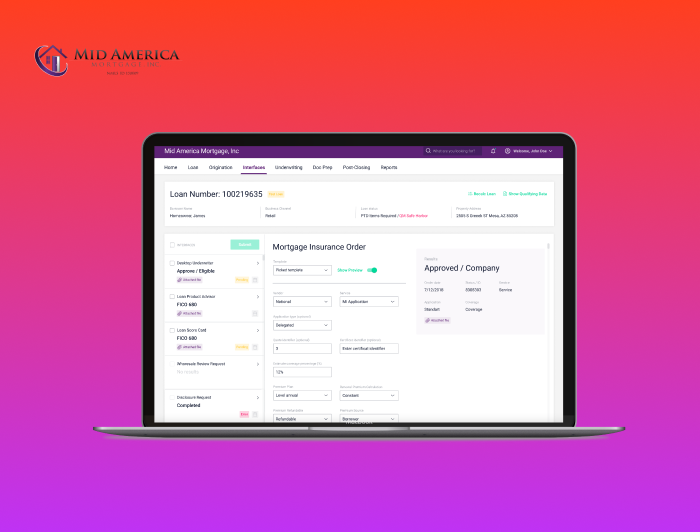

- Mortgage lending. Software development vendors specializing in fintech can help you develop a mortgage lending solution tailored to your specific needs so that your organization secures the best interest rates and terms that fit their budget.

- Home equity loans. This type of loan can provide clients with the funds they need to make home improvements, pay off high-interest debt, or make other major purchases.

- Auto loans. Auto loan software solutions streamline the application and approval process, as well as provide tools for managing loan portfolios. Some auto loan software solutions also offer features for tracking vehicle sales and managing customer accounts.

- Business loans. Some common features of lending software solutions encompass tracking and managing loan applications, disbursements, and repayments; automating loan approvals and decision-making; and integrating with other financial software applications.

Lending as a service providers offer a suite of lending products and services that can be integrated into a company’s existing business model. As a new, technology-driven way to provide solutions to clients, it serves as a more efficient approach that allows customers to optimize their lending.

Final Thoughts

Lending as a service is a critical part of fintech and will continue to be so in the future. It has the potential to revolutionize the lending industry by making it easier for borrowers to access credit and reducing the cost of lending. LaaS is an attractive option for companies that want to enter the lending space but lack the expertise or resources to build a lending platform from scratch. Lending as a service providers can also help companies that already have a lending platform but search for new strategies to expand their product offerings or enter new markets. Given the industry’s dynamic growth, an increasing number of companies will hone their competitive edge with innovative Laas solutions.

NerdySoft is a dedicated software development team provider that brings together technology devotees. Our highly skilled and passionate developers team has profound experience in mobile and web development, UX/UI design, DevOps services, QA, and technology consulting. If you are looking for a reliable partner who will take a product role in your software development process and solely focus on the result — NerdySoft is the right partner to choose. Interested to learn more? Don’t hesitate to contact us.

Latest Insights

Stay informed on the latest updates and trends to follow in financial services, digital transformation and software development from NerdySoft