The Most in Demand Fintech Mobile Applications and How to Develop for Fintech

The world of financial services, bank accounting, and money management has rapidly changed since the beginning of the internet. Online shopping and social media have changed the way we do everything.

In recent years, there has been an explosion in the utilization and variety of technology applied to the way we handle our money. This has led to the advent of the fintech industry, specifically the areas of fintech app development and fintech mobile app development. Fintech is a shorthand term for financial technology. Even if a person doesn’t trade on Robinhood, owns Dogecoin, or buys things with PayPal, they still have probably installed and used at least one fintech app.

The world of banking is changing. It goes online, leaving everyone resistant to progress at the bottom of the ladder. Digital transformation for the banking industry is inevitable, especially considering the coronavirus aftermath that will stay with us for quite some time. No wonder that financial companies, banks, and startups are following the digital banking trends and investing in the development of new mobile banking solutions aiming to disrupt the way people manage personal finance or send money.

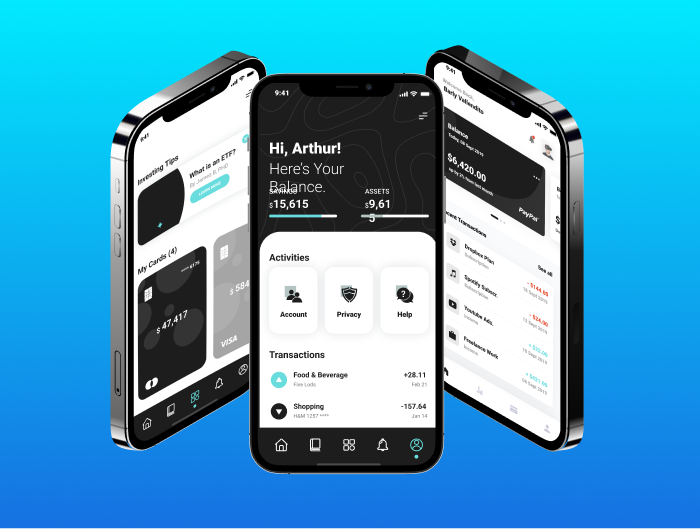

Online as well as traditional financial institutions are turning more and more to fintech applications to keep up with changing technology and consumer expectations. The array of fintech apps continues to rapidly expand from virtual banking software, loan management platforms, real-time transactions, payment processing centers for neobanks to mobile apps for instant credits.

There has been a significant decrease in the use of physical banks since 2017. According to TechCrunch, by the end of 2020, 90% of mobile users had paid online, with 36% of them doing so with a payment app. Statista says that in 2018, about 61 percent of Americans used digital banking, which is set to rise to 65.3 percent by 2022. As of 2020, as many as 1.9 billion individuals worldwide actively used online banking services with that number forecasted to reach 2.5 billion by 2024.

What Fintech Applications Are in Demand?

Why Develop a New Fintech Application?

How Do You Develop a Fintech App?

Software development and the software development process are part of a well-defined discipline, and we will not attempt to summarize all of that information here, but there are a few basic steps that you can follow to structure your fintech app development process around.

As with any business, you need to define your vision and product. With the Fintech industry, it is very important to identify your niche, ensure your product fits within that realm, and that you can easily differentiate it. Another factor that is extremely critical for Fintech applications is to thoroughly assess and ensure compliance with all the legal and regulatory rules. These differ from country to country and even within countries.

The next obvious step is to build or acquire your development team. Again, this is a separate story by itself, but we will mention that this is where you can assess whether you can outsource your development and/or technical efforts. A closely related task is to determine what technology stack to utilize. Your development team should help you figure this out, but it is key to select a technology stack that will be easy enough to maintain and scale within the next couple of years.

- Popular frontend development solutions for application developers building a fintech app are JavaScript with the Vue.js, React.js frameworks, and Python with Django or Flask.

- Python, Java, Scala, and Golang are good for backend development.

- Some good mobile application development solutions in the Fintech space are built with Swift used for iOS, while Android requires Kotlin.

- If you are looking for cross-platform app development, then React Native and Flutter are good options.

Once you have your team and your tech stack decided on, the next phase is to design the architecture of your application. Define the features, which should include things like a simple and user-friendly interface, data visualizations, and utilize gamification wherever possible to keep users engaged. On the system side, leverage cloud services to keep your infrastructure costs low. All of the above things will lead you into the planning and budgeting process. You will then be able to estimate your schedules and costs for your product.

You should create a Minimum Viable Product (MVP) as quickly as you can to start assessing your app’s potential. The MVP will transition you to actually building full-fledged high-quality fintech solutions, and you should then focus on testing and quality assurance. The final step in the process is to set up solid support processes. This will be critical for the ongoing success of your application.

What Should My Fintech App Have or Do?

As with any successful application, a new Fintech app must have the features and functions that users expect and want. What are the most significant features for your fintech app? There are several basic things that you need to have.

Communications are also a key user experience functionality the app should excel at. Highly customizable notifications (push and pull) should be available to keep users up to date on all the latest information.

Another trend in the technology services space is the usage of artificial intelligence and machine learning to power chatbots. Having bots provide customer service is not a new trend, but it is expanding, and the utilization of AI and big data is making the bots more effective than ever. Bots are also cost-effective versus having human beings provide customer service.

The next major feature a fintech app or mobile app must have is very robust APIs and integrations. It is key in the world of multiple platforms and legacy systems that an app be extremely versatile at communicating with a wide variety of applications and programs. We previously mentioned big data regarding chatbots, but it is also vital that a Fintech app utilizes big data to perform functions and gathers and disseminates big data for other uses. Big data is a market unto itself and an entirely different topic.

Microservices provide a means to structure an application as a set of interrelated services. This methodology is beneficial for cross-platform interoperability. This ties back with integrations but also makes your application compartmentalized and more easily updated. Using a microservices style of service-oriented architecture (SOA) also gives you the flexibility to leverage cloud-based and services provided from outside your app (public APIs).

The last set of features you should incorporate into your application is based on the popular trend towards more human-related interfaces. NLP (Natural Language Processing) and voice technologies allow you to make your app more user-friendly, enabling people to communicate more easily with the app. Another related interface is facial recognition, which is mostly used for security.

Why NerdySoft for Your Next Fintech Mobile App Development Project

If you are looking to get into Fintech, follow the big names like Lemonade (insurance), Robinhood (investing), Starling, Monese, (banking), and 6 Clicks or Passfort (Regulatory Technology) to learn more about the current trends in the Fintech industry.

The best solution, though–trust the software design and development of your fintech mobile app to professionals. At NerdySoft, we have strategic technology consultants with vast experience in Fintech to validate your fintech product concept, digitalize operations, reduce costs and implement innovative technologies.

NerdySoft provides services for companies across the whole financial ecosystem:

- Digital Banking Software engineering

- Money Transactions Platforms engineering

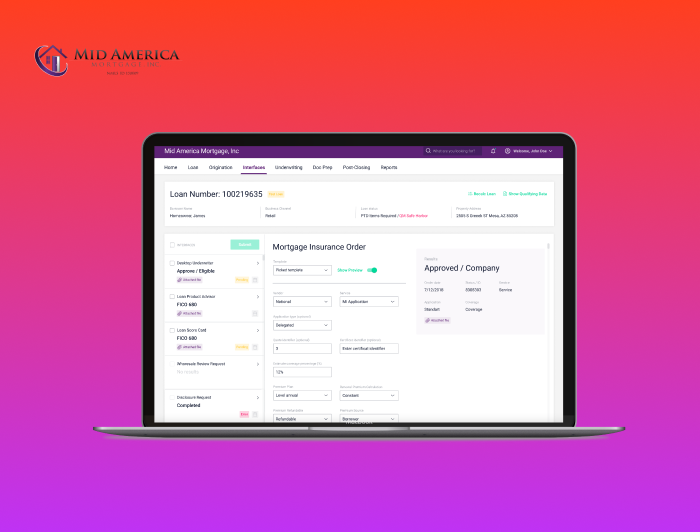

- The mortgage loan management platform

- Merchant payment processing center development

- Online Trading and Exchange Platforms engineering

- Direct Lending Platforms engineering

- Financial Applications development

Contact us for the development plan and estimates for a scalable fintech application that will impact the financial industry.

Latest Insights

Stay informed on the latest updates and trends to follow in financial services, digital transformation and software development from NerdySoft