What Is Digital Banking: Meaning, Types, and Benefits

In the last decade, a major shift in the banking industry has occurred, and today, an increasing number of clients are moving away from traditional banks toward digital banks. According to Statista, 65.3% of Americans use digital banking in their everyday life. One of the most important reasons for this is convenience. With digital banking, you can do everything from checking your balance to transferring money – all from your phone or computer. This shift has been accelerated by the COVID-19 pandemic, as people have been forced to stay home and do more online. But even before that, the trend was clear: digital banking is the future. In this article, we’ll take a look at what digital banking is, how it works, and why it’s become so popular.

What Is Digital Banking?

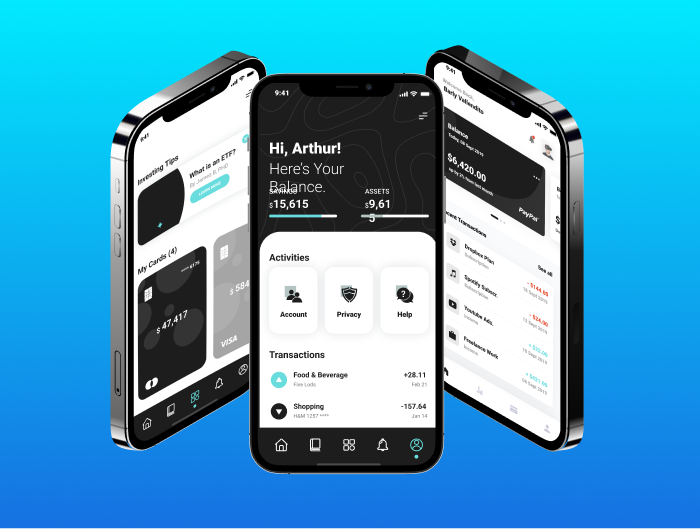

Digital banking is the umbrella term for all banking services that are available through digital channels, such as websites or mobile apps. This includes activities such as opening an account, transferring money, paying bills, and applying for loans. Lots of banks now offer digital banking services, with an increasing number of financial institutions becoming exclusively digital. Digital banking is often seen as a more convenient and efficient way to do business, as there is access to services previously available only at a bank branch. Digital banking solutions can be faster and easier to manage from the user’s perspective, and they often provide 24/7 access to the account. Additionally, digital banking can help you keep track of your spending and budget more effectively.

Digital Banking vs. Online Banking

The main difference between digital banking and online banking is that digital banking refers to the broader use of digital technology in the banking sector, whereas online banking refers to the use of the internet to conduct banking activities and provides basic banking functions such as account management and statement access. Digital banking systems are much more complex and often rely upon high-level process automation, web-based services, and APIs that guarantee a high level of security and flexibility. Modern banking solutions shape a digital customer journey and generate key analytics to advance decision-making and promote enhanced effectiveness.

Digitalization in Banking

In the banking industry, digitalization refers to the use of digital technologies to streamline the delivery of banking services. The transformation includes online banking, mobile banking, and other digital channels that provide a more convenient and efficient experience for customers. Digitalization has transformed the banking industry in recent years. Making banking services more accessible and convenient, it has made it easier for people to manage their finances. It has also allowed banks to reach new customers and markets.

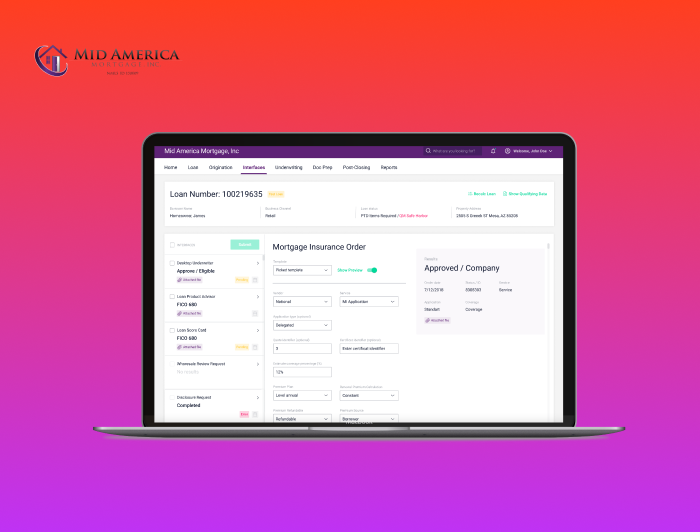

The use of digital technologies has empowered banks to cut costs and improve efficiency. For example, online banking and mobile banking apps enabled users to conduct transactions and manage their accounts without having to visit a bank branch. This change has resulted in reduced queues and shorter wait times for customers. Digitalization has also made it possible for banks to offer new and innovative services. For example, some banks now offer customers the ability to open an account and conduct transactions using only their digital bank account. Yet, the banking industry is still in the early stages of digitalization, and there is vast potential for further innovation and growth in this area. Digital technologies have the potential to totally transform the way banks operate and provide services to their customers.

Types of Digital Banks

With the rise of new models of digital banking, financial institutions can live up to the potential of innovative technologies as never before. Below are four common types of digital banks:

- Neobanks are digital banks that offer only online and mobile banking services. They don’t have brick-and-mortar branches and use digitalization as a core foundation for their development.

- Challenger banks are digital banks that are trying to compete with traditional banks by offering innovative products and services.

- New banks are traditional banks that have recently started offering online and mobile banking services.

- Nonbanks are financial institutions that provide banking services but don’t have a banking license. They don’t accept deposits or offer checking and savings accounts.

Benefits of Digital Banking

The benefits of digital banking are numerous, from enhanced convenience to the innovative user journey. Let’s take a closer look at how you can gain an ace up your sleeve with digital banking:

- Increased efficiency. Digital banking is a more efficient way to manage your finances. You can keep track of your account balances, transactions, and bills in one place. This makes it easy to see where your money is going and to make sure that you are not overspending.

- Reduced costs. Digital banking can help you save money on fees and interest. For example, you can set up automatic payments to avoid late fees. You can also compare rates between banks to find the best deal.

- More convenient. Digital banking is more convenient than traditional banking. You can access your account anytime, anywhere. This is especially helpful if you need to transfer money or make a payment when you are not near a bank branch.

- Higher security. Digital banking is more secure than traditional banking. Most digital banking platforms use data encryption to protect your information and often require additional security measures like two-factor authentication. A security-oriented approach reduces the risk of identity theft and fraud.

- Data-driven decisions. Digital banking can help you keep track of your spending and better understand your overall financial picture. This can help you make more informed financial decisions and wisely plan the financial future with data analytics.

Final Thoughts

In the future, digital banking will continue to grow in popularity as it offers a convenient and secure way to manage finances. An increasing number of banks and financial institutions will offer new digital banking solutions, and new features and capabilities will be added to meet the needs of customers. Other innovations may include the use of Artificial Intelligence (AI) to provide personalized advice and recommendations.

NerdySoft is a software development team provider that gathered together technology devotees from all over the globe. Experience in FinTech, CreditTech, HealthTech, and E-commerce empowers us to turn ideas into successful digital solutions. Interested in learning more? Don’t hesitate to contact us.

Latest Insights

Stay informed on the latest updates and trends to follow in financial services, digital transformation and software development from NerdySoft