Digitization in Finance

Digital transformation is one of the notions many industries currently pursue. The same is true for the realm of finances. Finding a good and reliable Fintech software development partner often means the difference between beneficial or futile finance digitization. Why does it matter?

First, the digital banking market is expected to reach a staggering $10.3 trillion by 2028. Second, the global digital transformation in finance is anticipated to rise to $164 billion by 2027. These numbers show that digital transformation is even now something companies operating in Fintech cannot afford to avoid. Moreover, many businesses need to envision digitization in finance at the forefront of their corporate strategy, with CFOs investing time and effort to ensure the process is implemented without hiccups.

Further, we offer deeper insights into finance digitization through the scope of its function, the technologies it entails, and the role of CFOs in the overall process. So, without further ado, let’s plunge into Fintech digital transformation.

Why Care About Finance Digitalization?

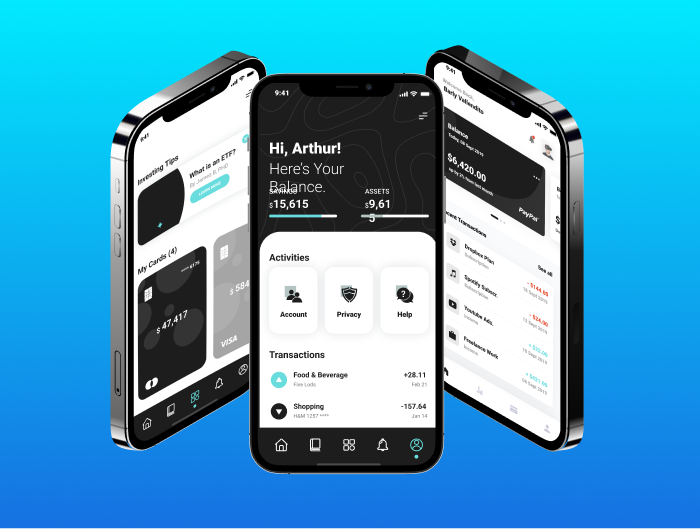

In short, digitization is streamlining processes by converting them into a digital realm. Often, digital transformation comes along with greater agility, simplicity, and a better flow of processes. For example, finance digitization help improves relations with clients, boost sales, and increase productivity. In such a case, thinking about how to build a Fintech app is something many companies should consider.

All these aspects are brought by the fact digital transformation allows businesses to manage customer data at an unprecedented level. In such a case, while streamlining processes and understanding customer needs better, Fintech companies use digitization to reach workflow efficiency. Bloomberg shows how digital transformation can redefine organizational workflows to achieve unparalleled efficiency. Putting all the pieces together, Fintech companies and banks should care about finance digitization if they want to have efficient workflows, streamline their processes, and learn from customer data.

Digitalization Finance Function

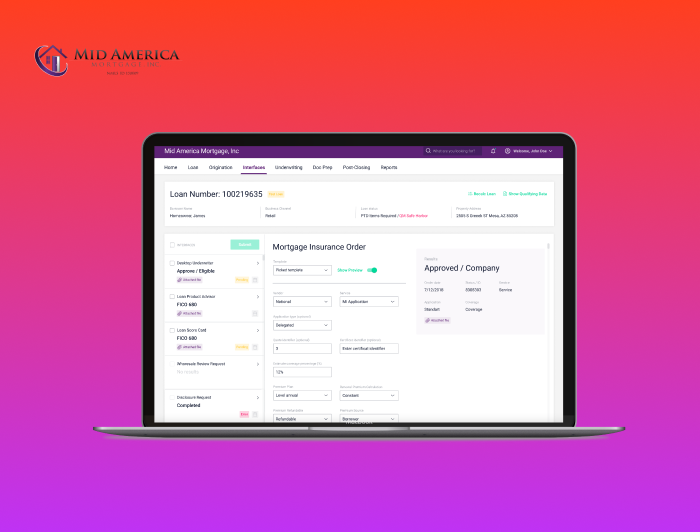

When it comes to financing, digitalization is a synonym for a top-priority investment. As we mentioned above, the process makes the workflows more efficient. Respectively, it means companies do not need to invest more time and money in handling them. As a result, Fintech firms get cost reductions and better processing time.

Deloitte makes several predictions on the role of digital transformation in the finance function and suggests that digitization comes along with automation and new business insights. At this point, finance digitization is not only a process of boosting efficiency, but it is the process of improving decision-making on all organizational levels as well. Keeping that in mind, Fintech companies must choose the right tools to drive digital transformation in finance to tap into the phenomenon.

The Role of Artificial Intelligence in Fintech Digitalization

Artificial Intelligence (AI) in Fintech is booming. GlobeNewswire reports that AI in the finance market is worth $10 billion and is expected to reach $28 billion by 2028. Keeping that in mind, one can assume AI plays a vital role in finance digitization. In simple terms, AI is a tool that helps process vast volumes of data in a fraction of the time. Besides, the algorithm can learn and self-improve. It means the more requests and transactions it processes, the better it becomes at doing.

Within the digitization of finance, AI helps improve performance management by granting data and insights into critical indicators that need to be improved. In addition, AI is significant in risk prevention. The technology analyzes historical data and can build hypothetical scenarios to anticipate whether a particular action will lead to elevated risk. Finally, banks and Fintech companies use AI to manage accounts and process numerous invoices. There is much AI can do in finances and accounting.

As a result, one can expect AI to revolutionize finance functions. It is anticipated that some financial professions will become more efficient because algorithms and not humans will complete them. With more time on financial experts’ hands, they can prioritize more important tasks and ensure the digital transformation is moving in the direction a business wants.

Finance Digitalization Consulting and Blockchain

When people hear “blockchain,” they immediately think of “cryptocurrency.” In reality, there is a much broader application of this technology in finance. Even though the instrument is in its infancy, the market is valued at $2.5 billion, it has already proved an important part of finance digitization. In a nutshell, blockchain helps make financial transactions fast, low-cost, and secure. And Fintech is always on the lookout for better security in finance.

The technology allows a company to store all the ongoing and past transactions in one particular ledger. While traditional software relays on various databases, blockchain enables faster access to data. Yet, like with any new technology, this instrument is still examined from the perspective of taxation and regulation. The critical issue is that blockchain drastically improves cross-border transactions, while there is no single body of legislation offering a unified view of the tool. One can say that technology promotes finance digitization, and bureaucracy cannot keep up with it.

How Can CFOs Promote Digitalization in Finance and Accounting?

Recently, McKinsey issued a report highlighting the key CFOs’ role in driving digital transformation. The gist of the piece suggests that CFOs should know whether the company’s organizational structure is ready to accept and adopt digital transformation. At this point, if a CFO calculates it wrong, there will be no effect from finance digitization except for money and time lost.

However, regardless of underwater stones, Gartner indicates that 69% of senior executives perceive digital transformation as a top priority in their corporate strategies. More interesting, digitization is placed above aspects like regulation, profitability, and talent management. In such a case, CFOs are the ones to recognize how a company can align with new technologies. Everyone looks to automate business processes, yet not everyone understands how to do it properly. Respectively, a CFO needs to know all the ins and outs of their company, market, and finance digitization.

Key Takeaways

We know several key facts. First, finance digitization is booming and will grow exponentially. Second, banks and Fintech companies use AI and blockchain to process data, make transactions faster, and enhance security. Third, the success of digitization in finance directly depends on CFOs and their ability to align digital transformation with the company’s organizational processes. Finally, it is a matter of time before AI and blockchain become inseparable from Fintech. As a result, the sooner companies hop on board, the more competitive advantage they receive.

Latest Insights

Stay informed on the latest updates and trends to follow in financial services, digital transformation and software development from NerdySoft