Fintech Cybersecurity: What to Look For

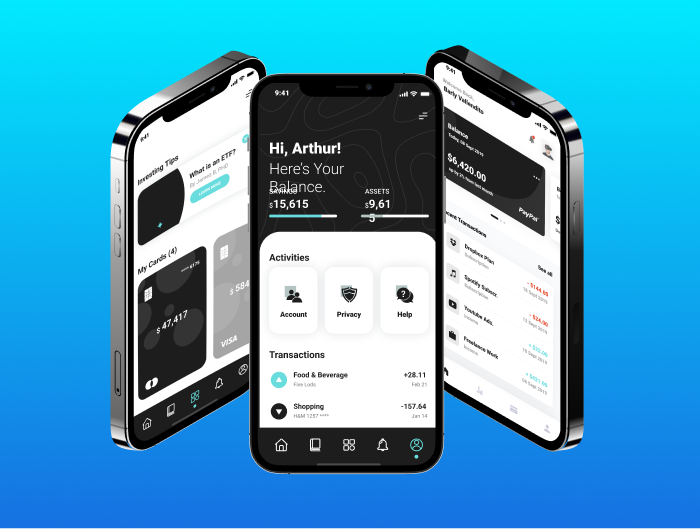

Fintech is a rapidly growing industry that utilizes technology to provide financial services. It includes mobile payments, peer-to-peer lending, and cryptocurrency. As the industry continues to grow, so does the need for cybersecurity in fintech. Cybersecurity fintech is the practice of protecting electronic information from unauthorized access or theft. In the fintech industry, this can include protecting customer data, financial information, and confidential business information. With the increase in fintech apps, companies, and the use of technology in financial services, cybersecurity is more important than ever. Learn as follows about fintech app security solutions, risks, and challenges.

Importance of Cybersecurity in Fintech

From mobile payments to peer-to-peer lending, fintech is making it easier and more convenient than ever to access financial services. However, as fintech continues to grow and evolve, so does the threat landscape. Cybersecurity is, therefore, more important than ever in the fintech industry. Financial data is some of the most valuable data on the black market, and as such, fintech companies are prime targets for cybercriminals. A data breach can lead to financial loss and reputational damage for a company and jeopardize its customers’ security and privacy.

That’s why it’s so essential for fintech companies to invest in solid cybersecurity defenses. They include everything from implementing robust security protocols to training employees in security best practices. By taking these measures, fintech companies can help protect themselves, their customers, and the industry as a whole from the growing threat of cybercrime.

Existing Cybersecurity Fintech Challenges

Developing a solid fintech solution that will strive for years is no easy task, especially considering the vast array of security challenges that come alongside. With this notion in mind, it’s crucial to review the modern fintech cybersecurity threats to understand how to cope with them in the long run. Here are some of the most crucial ones:

- Social engineering. While some of the most notorious cyberattacks are related to software or hardware vulnerabilities, no one should disregard social engineering as a whole. In particular, social engineering attacks continue to be a significant threat to fintech organizations and are mostly related to security on the customer side. The major challenge for enterprises is to ensure that customers can identify the corporate messaging and not fall into social engineering tricks.

- Securing mobile devices and applications. Mobile devices and applications are increasingly being used for financial transactions, making them a prime target for cyberattacks. Financial institutions must implement strong security measures to secure mobile devices and applications, such as two-factor authentication and data encryption.

- Preventing denial-of-service attacks. It’s a type of cyberattack in which hackers flood a target system with traffic to overwhelm it and prevent legitimate users from accessing it. To prevent denial-of-service attacks, financial institutions must implement security measures to detect and block suspicious traffic.

- Guarding against phishing attacks. It’s a common type of cyberattack in which cybercriminals send fraudulent emails or texts to trick victims into revealing sensitive information, such as login credentials or financial account information. To protect against phishing attacks, fintech enterprises must educate their employees and customers about the dangers of phishing and implement security measures to detect and block phishing emails and texts.

- Protecting against data breaches. Financial institutions constantly collect and store sensitive customer data, making them a prime target for cyberattacks. To protect against data breaches, financial institutions must implement strong security measures, such as data encryption and intrusion detection systems.

Each of the mentioned risks is considerable and thus should be treated seriously. If your company looks for custom solutions to these challenges, browsing the below solutions would be helpful. Their continuous adoption will help reassess the existing policies and boost your risk prevention policies.

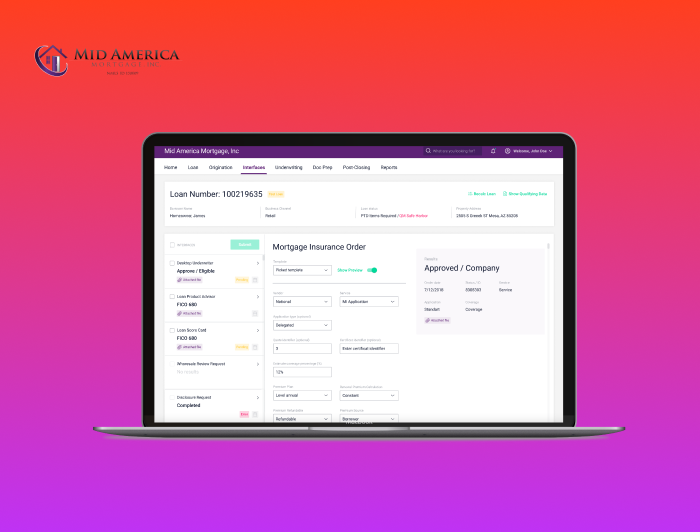

Fintech Cybersecurity Solutions

Fintech and cybersecurity go hand in hand in ensuring stable and uninterrupted access to customers’ funds and accounts. Since cybersecurity is a significant concern for most fintech firms, reviewing viable solutions is a must, which might be handy during the development and support phases.

- Data encryption. While encryption seems industry-standard across enterprises, not all organizations comply with the general rules when working with sensitive data. Using complex encryption mechanisms, such as RSA or 3DES, is a well-rounded solution to store all the customer data in a safe surrounding, minimizing data breach threats.

- Authentication and access controls. One of the most crucial fintech cybersecurity risks relates to authentication and access approaches. Financial organizations should implement strong authentication measures to protect customer data and prevent unauthorized access to systems and data. It can include two-factor authentication, biometric authentication, and other identification and verification forms.

- Role-based access. Even if you’re working in a start-up neobank that shares equal access to all databases across team members, reshaping this framework is necessary. The role-based access in fintech refers to the system that enables access to data based on one’s role and affiliation. Some possible roles include managers, administrators, data engineers, support representatives, and customers. Distinguishing the access models might be helpful for business continuity and sustainable growth.

While the mentioned three solutions are the most relevant, the use of AI, for instance, also stands out as one of the solutions to the growing cybersecurity risks. Other possible solutions include security awareness training, partnering with a reputable third-party provider, and adopting secure development procedures. Regardless of what order you take in adopting these best practices, it’s best to assess your organizational capacity first.

Final Remarks

It’d be dubious to say that cybersecurity is something from the past, especially with the growing need for fintech software. Regardless of your company size and niche in the fintech industry, it’s crucial to regard cybersecurity seriously. Now, it has come to the point where it’s no longer viable to ignore threats, data breaches, and possible infrastructure vulnerabilities. If you have any concerns regarding your organization’s security measures, partnering with a reliable service provider is crucial. For more information, don’t hesitate to contact us so we can tailor a custom solution for your fintech project business needs.

Latest Insights

Stay informed on the latest updates and trends to follow in financial services, digital transformation and software development from NerdySoft